2026 Investable Ideas

The 2026 macro trends I am putting capital behind...

This is part 2 of a 3 part 2026 outlook series. Part 1 was released last week and is linked below.

Macro Themes

Investable Ideas (we are here)

Top Picks

Picking up where I left off in Part 1, I wrote “asset dispersion will be profound between winners and losers and the main focus is finding ‘win-win’ setups”. This post is intended to help parse signal from noise in order to think through some of those setups.

Remember when the phrase “unprecedented times” became used so often around and after COVID that the joke started to write itself? Well the new word I am nominating to promote to that level is “paradox”. Everywhere I look I find myself describing things as a paradox. Some examples:

How is “run it hot” the most consensus theme of the economy when the underlying labor market points to a deep recession?

How are stock markets at all-time highs with consumer sentiment at all-time lows?

The simple answer is that markets today are a result of years of band-aid and duct tape style solutions to fixing the economy. I describe 2026 as a delicate balance to keep all of the balls juggling in the air without dropping. The delicateness is a result of years of kicking the can on our problems for the next administration and generation to face.

With that said, do not let the growing complexities overshadow the realities of the current market environment. Instead I suggest focusing on the incentives of key decision makers, demonstrated reaction functions and historical precedent. The key to dominating 2026 will be aligning behind the trades that sit at the crosshairs of the competing objectives.

1. Main Street Reignition

The K-shaped economy is a household term at this point so I don’t think I need to repaint that picture again here, but I will try to offer a new perspective. Throughout 2025, when push came to shove, the Trump administration resorted to a market-first approach that has continued to resoundingly benefit Wall Street/large corporations/AI technocrats at the expense of Main Street. It’s not that they necessarily want to change that, but rather will need to reorient their prioritization if and when a growing tension arises. The reason a “run it hot” policy strategy is even required is a result of the societal issues negatively affecting the “bottom half of the K” that have festered unabated for years. A true run it hot scenario is bearish for long duration assets as yield curves bear steepen and the cost of capital rises, which is at complete odds with the suppressing of long-term interest rates that has directly benefited speculative and technology assets in recent years. The “run it hot” effects look differently when equity multiples and index concentration levels are at record highs and investor cash balances at record lows. The idea I want to stress is not as much a directional call as it is an asset selection call. There will be big winners from this regime but finding them will likely require going where others are not and doing things differently.

Assuming you believe in the high stakes magnitude of the midterms and the government reaction function to stimulate fiscally and keep monetary policy loose to try to win, the most obvious resulting trade to me is betting on long-term yields to rise. Whether the policy works and sends nominal GDP to 8% or it doesn’t because the recessionistas have a point and the economy is too weak to catch its gear, I don’t think the specifics of the outcome doesn’t really matter a whole lot for this bet to win.

2025 taught the Trump administration a huge lesson - publicly touting "it's Main Street's turn" and a message of "taking pain" backfired bigly. It caused a record sell off that forced a walk back of rhetoric and delay/reversal of policy objectives.

2026 will demonstrate they've learned that lesson and will act accordingly. 2026 is about "Main Street's turn" because if it's not, they will lose the midterms and Trump's safety, wealth and legacy will come under attack. It HAS to be "Main Street's turn" this year or else. However, they are going to adapt to the mistakes of 2025. They will be more subtle and less blatant in their communications as to what parts of the market this is a negative for. They can't have a wealthy/corporate tantrum like they did after Liberation Day or their agenda will be stopped in its tracks once again.

You can already see this in how the market is trading. While they were touting "Main Street's turn" in early 2025, the market knew that wouldn't be the case as small caps topped in November while Nasdaq continued to make new highs into February. Most of 2025 was an anti-growth/countercyclical policy agenda. Today we have the exact opposite setup from a policy perspective and once again the market is sniffing out this changing of the guard.

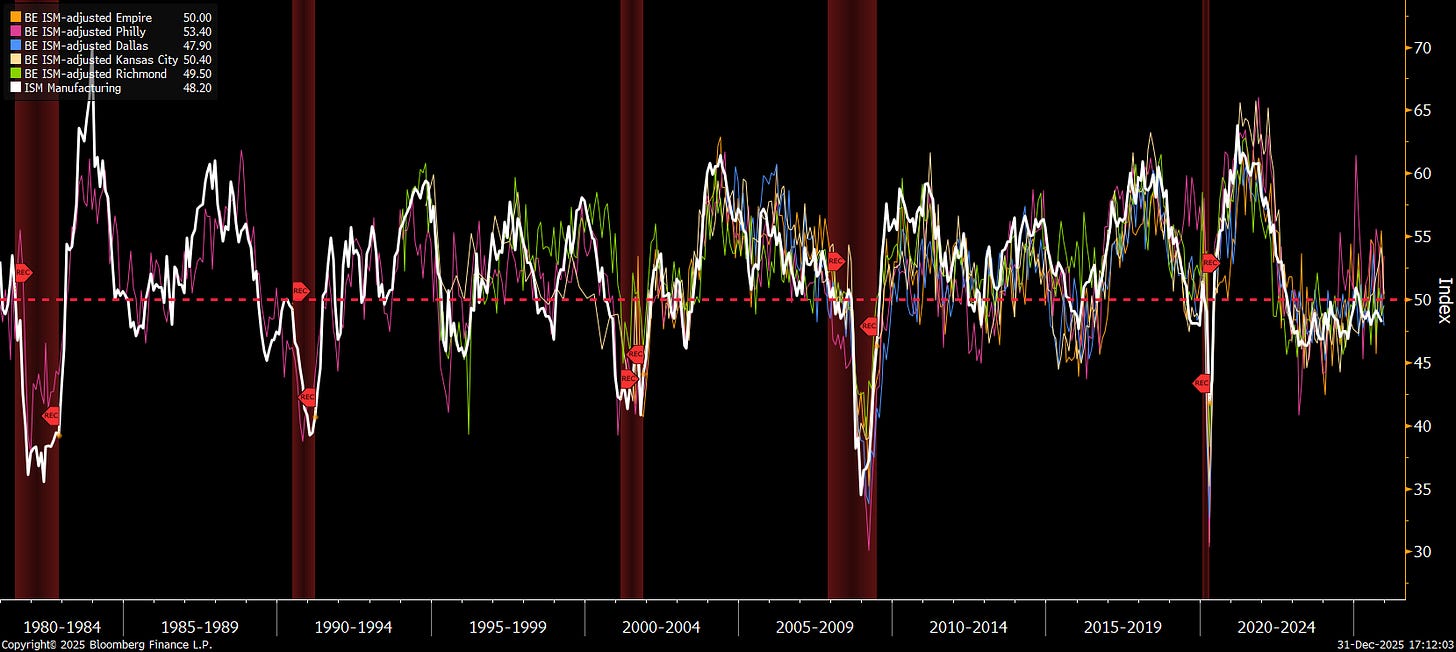

The below image is a look at the regional Fed ISM survey data over time. You can see the indices going below 50 (contractionary) in late early 2023 around the time of the regional banking crisis. Since then they have remained in contraction, albeit with a slow, gradual improving trend higher. I posit in 2026 we see readings >50 into expansionary territory.

We are coming out of a nearly ~2 year main street recession (main street can be translated as the highest propensity to spend and consume goods and services cohort), and bond yields couldn’t fall during that period. Sprinkle on top of that we are turning the page on a 2025 that was all about anti-growth/countercyclical policy. These agenda items included tariffs, immigration and deficit reduction, and the one-time negative effects of these will roll off this year.

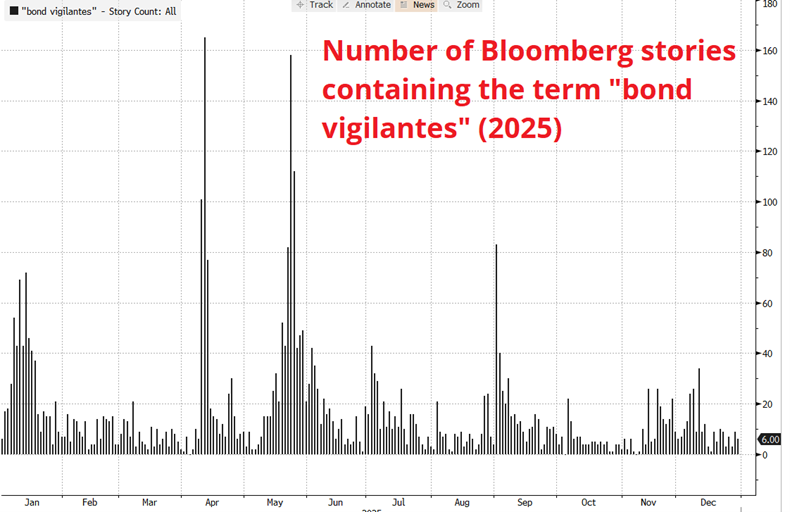

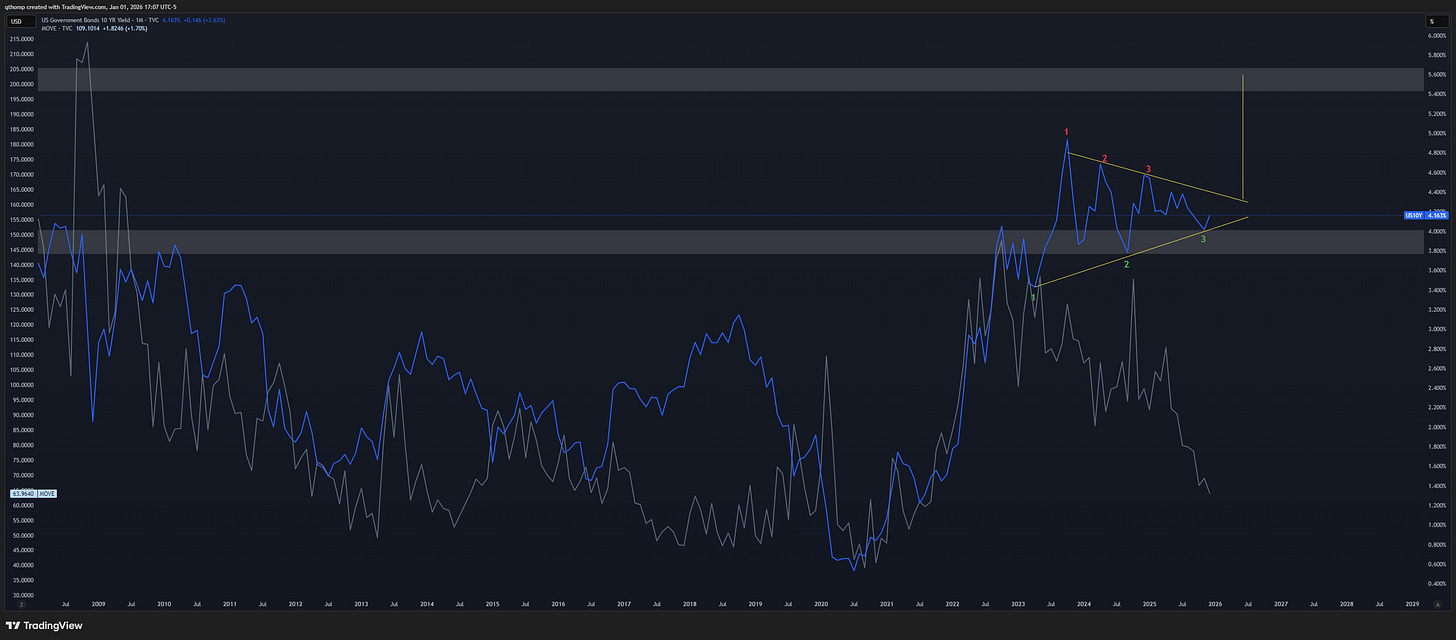

Shoutout to Brent Donnelly who I got this chart from, but you can see the tapering off in sentiment around the bear case for US Treasuries.

When you zoom out, even these last few years look like a long hibernation period. On a longer-term chart, the 3.75-4% area looks like a major resistance zone turned into support for the US 10Y yield.

The monthly chart looks strong and particularly so when paired with the idea that the largest and most pain-inducing deficit effort in recent history has ended with a 5.5% annual deficit to GDP.

Now overlay this with bond volatility via the MOVE index.

The Trump admin has a choice in 2026 - stimulate Main Street to win the election or keep a lid on bond yields. The former will take priority and the latter will be chased like a dog on a leash.

2. A New Fed Policy

A core pillar and result of the “run it hot” policy strategy is a steeper yield curve. This stems from higher nominal GDP as a result of fiscal stimulus that serves as a tailwind to long end yields. But there is also a monetary policy prong to the strategy that we are seeing in real-time - pressure to keep front end rates as low as possible. Financial repression would be another phrase to describe what we are witnessing, but that has much more negative vibes so you won’t hear policymakers mention it.

The steeper yield curve is also being reinforced by a policy change the Fed began late last year that I still don’t think is getting enough attention. While their policy is supportive of the front end via Fed Funds rate cuts and the newly announced Reserve Management Purchases (RMP), it is doubly bad for the long end. First, that front-end liquidity helps to support growth and financial markets which puts somewhat of a floor on long end yields. But more importantly, they are actively reducing the Fed’s balance sheet duration, which I believe may be a first since the 1950’s bills-only policy. To repeat it again, I do not believe this aspect is being appreciated enough by market participants. Look no further than the exact bottom in long-term yields being put in the day the Fed announced this shift in late October. I am of the view this is why Bitcoin and momentum assets got hit hard in November.

It’s important to point out that this yield curve steepening impact is the exact opposite of what fiscal and monetary policymakers have done since the risk asset bear market ended in October 2022. From then on through 2023 and 2024 we saw large, continuous efforts to do the opposite - suppress long end yields. This was done via the BTFP in March 2023, ATI in October 2023, draining $2T from the RRP and slowing/ending QT early. Given this 180 degree pivot in policy strategy, it should come as no surprise that the market should see leadership rotation.

Long assets that perform well in a steepening yield curve environment and stay away from ones that don’t. Cyclical and industrial commodities, energy and financials benefit here, whereas long duration, speculative assets and technology should lag. This approach happens to dovetail nicely with the main street reignition idea as well. Stimulus to the highest propensity to spend consumers is likely to boost demand for tangible goods and services more than it is for financial and intangible assets. Position accordingly.

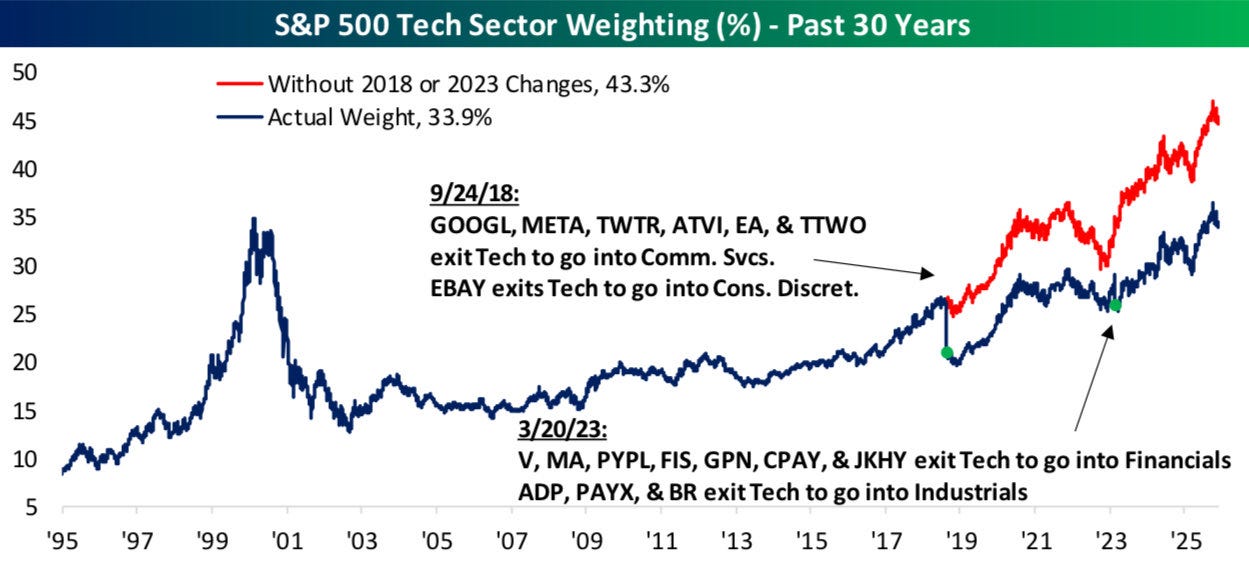

This decision is also made easier by the fact that concentration among the top technology companies is at all-time highs. With everyone piled into the same boat, it doesn’t take much of a changing tide to translate into big shifts in financial markets. The US stock market is now AI. The big tech monopolies, or Mag7 as we like to call them, have become too big to fail as they are now one of the core pillars of the US retirement system and source of government tax receipts. Historically, investing in too big to fail enterprises works until it doesn’t. More on this later.

3. Global Focus and Continued Non-US Outperformance

The US stock market as defined by the S&P 500 is tech and AI which is all of the talk of markets today. It is overlooked that many non-US equity markets outperformed in 2025 and I think will do so again in 2026. 2025’s non-US outperformance was a warm up with the main event is still ahead.

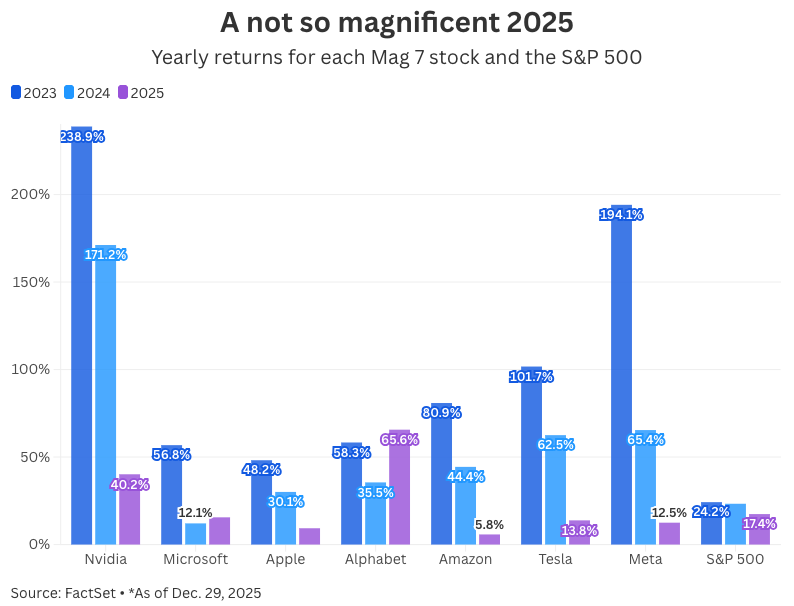

For starters, Mag7 returns have been on the decline, as have their revenue and earnings growth metrics. It’s not often discussed that most of them underperformed the S&P 500 in 2025.

The same vibe holds true for the tech sector broadly which comprises a record market concentration.

Given I believe both fiscal and monetary policy in 2026 will be focused on supporting main street and many other places besides tech, in addition to what I believe is a concentration problem, it’s not an area I am excited to invest in. A similar fiscal stimulus phenomenon is also happening globally as fiscal deficits are not just a US thing. China for example is likely to run a larger deficit in 2026 than in the US, which is particularly interesting given their focus on domestic consumption. Meanwhile Chinese equities still trade extremely cheap to US and we know their technology sector, among many others (Uranium, EVs, solar, etc.) are at a minimum competitive with and at a maximum superior to their US counterparts.

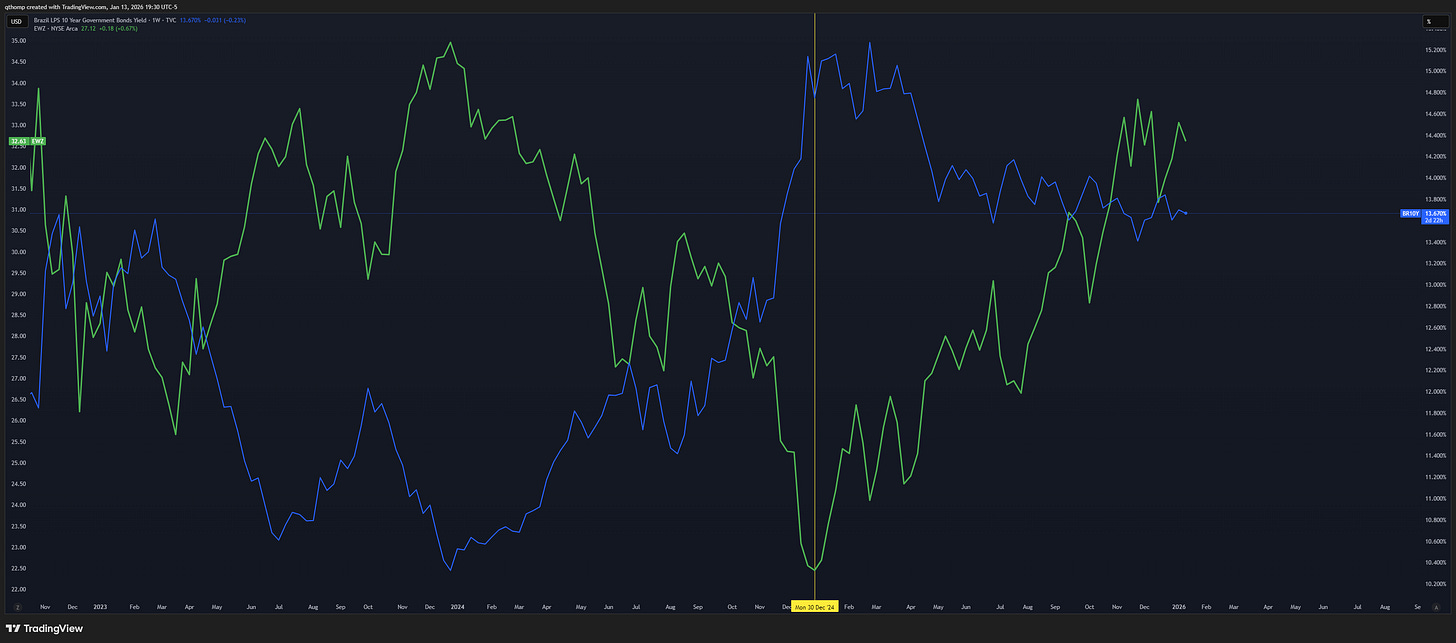

One screen I have run globally for idea generation has been looking into countries whose bond markets are performing the best. Given the fiscal sustainability problems plaguing developed markets, investing behind countries with the healthiest bond market trends could be a ‘keep it simple stupid’ way to allocate capital across this theme. China fits this bill and has much more room in their bond market to stimulate fiscally. Brazil is another example along this line of thinking.

One reason for this dynamic is the US’s trade deficit reduction with China has forced those cheap goods to go elsewhere around the globe, creating a deflationary force for every other country. This should continue to be a tailwind as the US deficit is still dropping and goods inflation out of China continues to be very weak. Central bankers around the world are welcoming this development with open arms, however it does create the same negative effects for their other policymakers tasked with preserving domestic industry competitiveness.

The last point to mention that’s separate but related to all of this is the US dollar which I expect to see another 5-10% decline in 2026. Liberation Day set in motion what was already a slowly melting ice cube of capital flows into the US peaking out. NIIP (net international investment position) in the US is at highs at a time when the White House’s policy agenda is aimed at shrinking the trade deficit which will result in less capital flows into US assets - both the stock and bond market. With foreign buyers already reducing their footprint in the US Treasury market, it is likely that the Fed will have to play a bigger role than before and that means debt monetization and dollar bearish. Additionally, it is likely the new Fed chair will be even more amiable to Trump’s loose policy suggestions, the effects of which would be seen in a lower dollar. Together all of this provides another tailwind to non-US assets.

4. AI Megatrend Persists But With Different Beneficiaries

It’s no question we are in a secular AI megatrend. We are a few years into it and just starting to see the benefits go mainstream. I suppose I should preface this by saying I am often speaking in broad strokes here. Given we are in an AI megatrend, there will be new winners that pop off every week on the back of this innovation. But when I am speaking about it here, I am generally referring to the large cap tech, Mag7 and semiconductor parts of the market - think QQQ, MAGS and SMH.

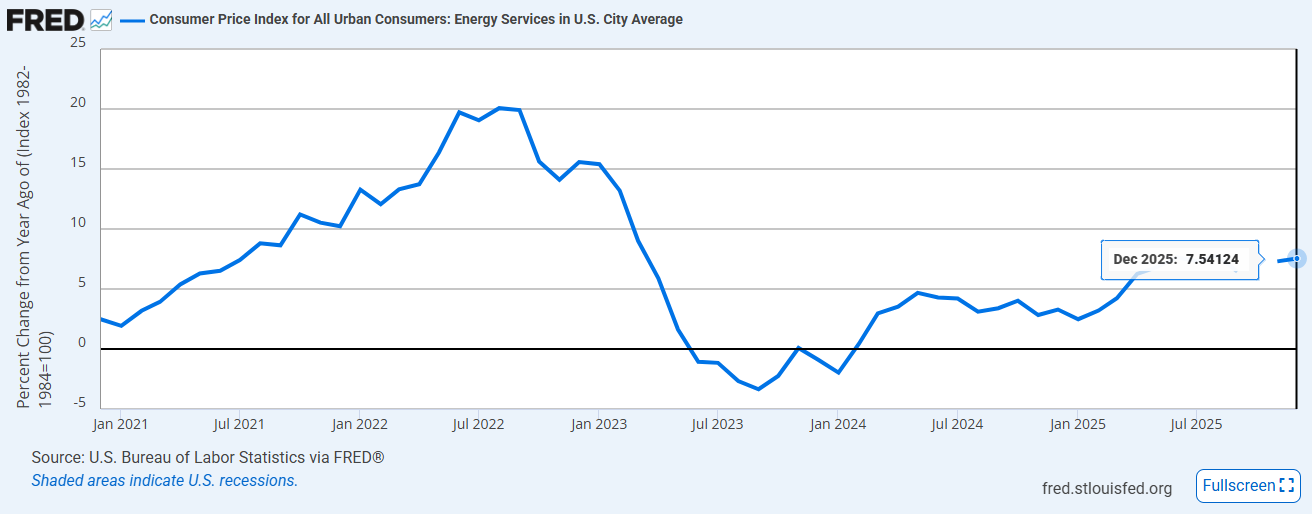

While the AI boom has been strongly backed and supported by the US government to date, there is a changing tide that is resulting from its impact on labor force reduction and job loss, as well as energy costs affecting the population. To understand the direction of travel of current political discourse, look no further than the recent few tweets from AOC, Elizabeth Warren and Bernie Sanders to find pushback against AI and datacenters. Democrats have found early success with this approach, and it will likely ramp in the coming months. Proof of this notion can already be seen in Trump’s latest rhetoric hinting at making tech companies pay for electric bills and power consumption, as well as more announcements coming on data centers.

This is part of the delicate balance the Trump administration will try to manage. With concentration of Mag7 and Semi’s at all-time highs, there is much more room for error than meets they eye. Not to mention the capex is increasingly hitting the debt market and potentially equity financing too as the capex burdens are becoming larger. This is a change in the previous capital-light big tech business models and has evolved into an AI “space race” that is almost certainly going to produce subpar rate of return investment decisions.

As the bottlenecks have moved from chips to datacenters and now to raw materials, it screens much more attractive to play this theme further downstream. It also dovetails nicely with the other market dynamics of main street stimulus and a steeper yield curve - an environment that benefits commodities and energy producers. The other approach that has seemed to work well is playing the tip of the spear innovators whose businesses are benefitting from incorporating AI to boost revenues or cut costs but I don’t have much edge in this area so have not been too focused on allocating capital to it. Here I am focused on power generation and energy plays that I expect to benefit from continued emphasis on grid buildout and secular sticky inflation.

5. Geopolitics

The final area I want to touch on may not typically be an area you want to place specific bets around, but one that needs to be incorporated at least to some degree. There are major geopolitical events that now have quantifiable odds of occurring via betting markets, but what I believe is more important is the trends and regime shifts that they may be signaling regardless of each particular outcome.

Let’s use the China - Taiwan situation as an example. I have no edge in predicting an outcome here so I try to stick to what I do know.

I believe whether it escalates to physical violence or remains ‘cold’, there is a clear power struggle ongoing between the two largest economies in the world vying for influence and leverage over each other to achieve the best outcomes for their national interests. This includes threats of military action, but also strategic supply chain decisions, hoarding and restricting key exports and forming alliances globally.

The US has amassed ~20% of its naval assets in the Caribbean and is becoming increasingly engaged in military conflicts globally (Venezuela, Ukraine, Israel/Iran, Yemen, Nigeria, etc.). A more active and deployed military means less resources are available for new future unknown conflicts.

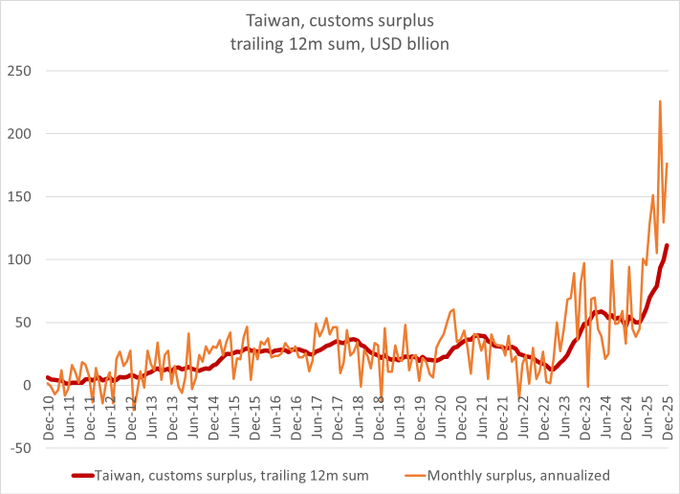

Taiwan’s importance and economic value is rising dramatically with the AI boom. See quoted tweet. Hot assets and rising stars of any type become more coveted by those around it.

While I do struggle to see how a move on Taiwan would not be mutually destructive, I also know that whenever humans are involved there can be volatility and what may appear to be ‘irrational’ decisions on the surface can be very rational when better understanding the incentives and power struggle under the surface.

The focus should be on placing bets that don’t require extreme outcomes to win. For me those look like:

Regardless of physical violence or not, adversarial competition means there is a premium placed on commodities, raw materials and scarce resources. Again, this dovetails with a broader macro environment that benefits commodities, cyclicals and curve steepening assets. Focusing on the most supply constrained and in demand cross sections of this venn diagram will lead to outsized returns.

There is a fairly wide valuation discrepancy across Chinese vs. American industries despite China’s competitiveness. This also comes at a time when the macro tailwinds are favoring non-US assets and a weaker dollar. Additionally, there’s a probable case in which China runs a larger fiscal deficit in 2026 with an even bigger focus on domestic consumption. Lastly, China has continued to make ground with the US in its competition for global influence and in many cases almost serving as the de facto central bank and financier for emerging markets, fitting behind an attractive broader macro theme.

Looping in geopolitics to all of this, it seems to me that one side of the equation is mispriced. Either there is real risk of geopolitical conflict with China/Taiwan and Mag7 and Semiconductors are way too expensive for that scenario, or the risk is much smaller than perceived and competitive Chinese technology firms are way too cheap relative to the tailwinds they have.

There’s obviously a number of different geopolitical events ongoing from Russia/Ukraine to Iran/Israel to Venezuela/LatAm to Greenland. All of these have different levels of relevance to markets and global economies as well as different probable outcomes and effects. It has been clear from the beginning that Trump’s #1 priority is to lower the price of oil to keep a lid on inflation and he will go to any length to do that. There is only so much that is in his control here after the low hanging fruit (Saudi deals) has been harvested. I think oil and gas is an attractively priced area to invest given my outlook for the space, but nonetheless, there other commodities that may have similar tailwinds but are more supply constrained. The whole metals complex has put this on full display for all to see - it is a field awash in opportunity for those willing to look deeper.

The funny part about “annual outlook” reports that we all like to write ahead of a new year is that for markets, the calendar year doesn’t mean a whole lot. We use YTD metrics to gauge results but assets don’t put in tops and bottoms or trend changes just because of clean month or year ends. I only write this because us humans have a tendency to get caught up in the new trends and directional calls and sometimes forget that new information can change the circumstances. Said another way, 6% bond yields, a 20% correction in Mag7 and a 20% move higher in metals and Chinese stocks might make me change my mind on a particular view. Markets are not static and investing rewards a dynamic mind. We must preserve our ability to hold multiple, often times conflicting, truths at once.

“It is the mark of an educated mind to be able to entertain a thought without accepting it.” - Aristotle

The 3rd and final part of this series will drop next week. As a macro investor my bread and butter is not single names but I thought it’d be a fun exercise to help me try to identify my strongest views, prioritize them and simplify into the most concise format possible.

Thorough macro framework - particularly the tension between “run it hot” fiscal aims and financial repression on the front end. These policy crosscurrents shape the day-to-day reality for trade credit and working capital: tighter lending spreads for some, higher funding costs for others, and a re-pricing of risk that hits mid-market B2B terms first. TCLM often explores that operational layer where macro signals become payment timing and credit decisions. A valuable read.

(It’s free)- https://tradecredit.substack.com/

Fascinating read. Thanks Quinn!