Beautiful Clean Coal: Energy Transition’s Forgotten Fuel

The bull case for coal equities in 2026

Full Report: The complete write up is available in document format here.

Summarized Version is below.

The Contrarian Setup

Coal is the energy sector’s most hated asset class. ESG mandates have made it uninvestable for most institutional capital. Consensus expects secular decline.

And yet U.S. coal generation increased 11-13% in 2025. Natural gas prices have structurally shifted higher. Data center power demand is accelerating faster than renewables can build. The Trump administration has delivered the most coal-favorable regulatory environment in decades.

This isn’t a call for coal’s permanent renaissance. It’s a thesis that the market does not yet fully appreciate the catalysts that could drive significant outperformance in coal equities over the next 12-24 months.

The Investment Thesis

Core premise: Coal equities offer asymmetric risk/reward because:

Natural gas prices have structurally increased (LNG exports create floor), making coal competitive for power generation

Steel demand is strong (SLX ETF +46% YTD 2025), directly supporting met coal producers

Power demand is accelerating from AI/data centers faster than new generation can be built

Regulatory tailwinds from Trump EPA rollbacks extend operating life of existing plants

Valuations are depressed 4.1x EV/EBITDA despite improving fundamentals

Understanding the Two Coal Markets

This is crucial: thermal coal and metallurgical coal are completely different businesses with different demand drivers, different customers, and different price dynamics.

Thermal Coal (Power Generation)

End use: Electricity generation

Customers: Utilities, IPPs

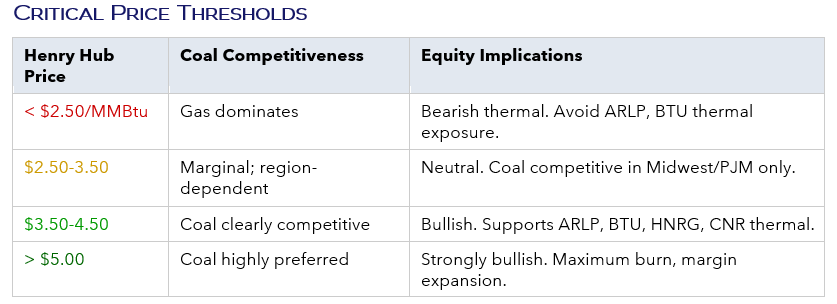

Price driver: Natural gas prices (fuel switching threshold ~$3.50/MMBtu)

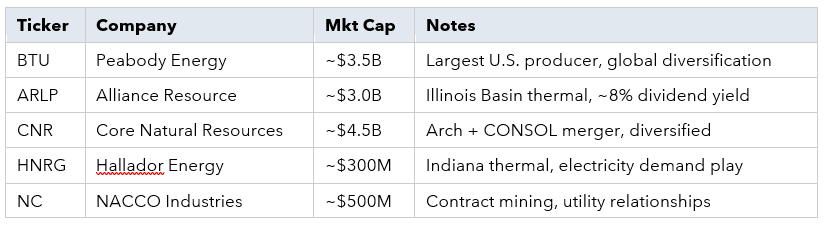

Key equities: ARLP, BTU, HNRG, NC

Metallurgical Coal (Steelmaking)

End use: Blast furnace steelmaking (irreplaceable for BF-BOF process)

Customers: Integrated steelmakers globally

Price driver: Steel demand, particularly from India and Asia

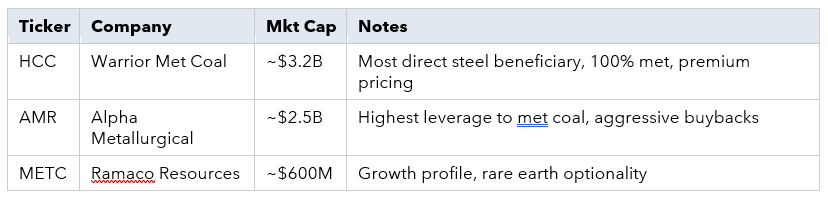

Key equities: HCC, AMR, METC

Understanding this distinction is essential for positioning. A rally in SLX (steel) benefits met coal producers. A spike in Henry Hub benefits thermal coal producers. Different trades.

The Natural Gas Connection

Here’s the mechanical relationship that drives thermal coal demand:

What happened in 2025: Henry Hub rose from ~$2.20/MMBtu (2024) to $4-5+/MMBtu. The EIA explicitly states: “Coal generation increased by 13% in 2025 due to more competitive fuel costs relative to natural gas.”

Why this is structural, not temporary: U.S. LNG exports increased 25% in 2025 to 14.9 Bcf/d, with another 10% growth expected in 2026. Plaquemines LNG and other Gulf Coast facilities are creating persistent demand for U.S. natural gas. The EIA projects Henry Hub to average ~$3.50/MMBtu in 2026 and $4.60/MMBtu in 2027—both levels supportive of coal generation.

The trading implication: Coal equity prices typically lag natural gas moves by 1-3 months. When Henry Hub spikes above $4/MMBtu, consider building thermal coal positions before the full earnings impact is recognized.

The Steel-Coal Nexus

For met coal producers, steel is everything.

Why steel demand = met coal demand:

70% of global steel is made via the blast furnace process

Every tonne of BF-BOF steel requires ~780 kg of metallurgical coal

There is no commercially viable substitute for coke in blast furnaces

Met coal serves as reducing agent, fuel source (~2000°C), carbon source, and structural bed

What SLX strength signals:

When the VanEck Steel ETF (SLX) rallies, it’s telling you:

Global industrial activity is recovering

Infrastructure spending is accelerating

BF utilization rates are rising

Met coal demand is increasing

The transmission mechanism: SLX tends to lead met coal equities by 1-3 months. If SLX rallies while HCC/AMR lag, that’s a catch-up opportunity.

Who Benefits Most from Steel Strength?

Tier 1 (Pure-Play Met Coal):

HCC (Warrior Met Coal): 100% met coal, exports to ArcelorMittal/Nippon Steel, most direct beneficiary

AMR (Alpha Metallurgical): 100% met coal, highest operating leverage, aggressive buybacks amplify per-share gains

Tier 2 (Significant Exposure):

METC (Ramaco): Met coal with growth profile, smaller scale but higher growth rate

CNR (Core Natural Resources): Arch + CONSOL merger, ~40% met coal exposure, owns Baltimore export terminal

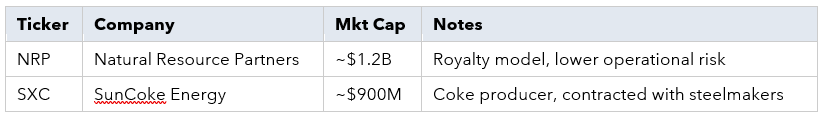

SXC (SunCoke): Coke producer with long-term take-or-pay contracts with integrated steelmakers

Tier 3 (Minimal Pass-Through):

ARLP, HNRG, NC—thermal producers with no met coal exposure; steel thesis doesn’t apply

The Political Landscape

The Trump administration has delivered substantial regulatory relief for coal. Here’s what’s happened and what it means for investors:

What’s Been Done

EPA proposed repealing all GHG emission standards for power plants

37% of U.S. coal capacity (~71 GW) received 2-year MATS exemptions through July 2029

Powder River Basin reopened to coal leasing

Coal designated as a “mineral” for permitting purposes

What’s Protected Through 2028

MATS exemptions extend to July 2029 regardless of elections

Once final rules are published, reversal requires 1-2 years of new rulemaking

Market forces (gas prices, power demand) operate independently of politics

What Could Change

2026 midterms: Democratic Congress could block further deregulation but can’t force new regulations

2028 election: New administration could begin rulemaking to reinstate standards (wouldn’t take effect until 2030+)

Courts: Environmental groups are challenging rollbacks; rulings expected 2026-2027

The Bottom Line on Politics

The American Action Forum concluded that Trump’s coal EOs are “unlikely to reverse the declining trajectory of U.S. coal production due to escalating mining costs, competition from other energy sources.”

This cuts both ways: Market forces drive coal demand more than EPA rules. Natural gas prices, power demand, and capital costs determine retirement decisions.

The Investable Universe

Pure-Play Met Coal (Steel Correlation)

Thermal/Diversified (Power Generation)

Royalty/Specialty

ETF Option - COAL Range Global Coal Index

Key Monitoring Indicators

Price Signals

Henry Hub Natural Gas: Critical threshold at $3.50/MMBtu

Australian Hard Coking Coal (HCC Index): Global met coal benchmark

SLX performance: Leading indicator for met coal equities

Demand Indicators

EIA Weekly Coal Production: Tracks production trends

Utility Coal Stockpiles: High stocks (>120 MMst) bearish; drawdowns bullish

Coal’s Share of Generation: Track via EIA Electricity Monthly Update

Political Calendar

Early 2026: EPA expected to finalize GHG standard repeal

November 2026: Midterm elections

July 2029: MATS exemptions expire

The Risk Case

What could break this thesis:

Natural gas collapses below $2.50/MMBtu for extended period (thermal coal thesis dies)

Global recession tanks steel demand (met coal thesis dies)

Utility retirements accelerate despite economics (structural headwind)

Court rulings invalidate EPA rollbacks (headline risk, but long implementation timeline)

Liquidity risk: Coal equities trade with lower volume than major energy names

Bottom Line

Coal isn’t coming back as a growth industry. The secular decline is real. But markets can be wrong about timing and magnitude.

The setup today:

Structural support from LNG-driven natural gas prices

Strong steel demand supporting met coal

Regulatory tailwinds extending plant lives

Depressed valuations with negative sentiment

This is a contrarian, cyclical trade—not a buy-and-hold forever position. The catalysts are in place for a period of outperformance.

What are your thoughts? Reply to this email or leave a comment below. Be sure to join the subscriber chat for additional updates.

Solid contrarian thesis. The LNG export floor on nat gas is probably the most underappreciated part here, becuase it fundamentally changes the switching economics that drove coal's decline over the past decade. I've watched utilities flip between fuels based on Henry Hub spreads, and that $3.50/MMBtu threshold is real. The lag between gas price moves and equity repricing creates actual alpha if timed right.