Praying to a God (the Fed put) that won't talk back

Complacency in the market has yet to price in that a Fed put does not exist in the same way today

The most talked about word in public discourse these days is inflation. A word that is said so much it’s almost become numbing. And rightfully so as millions of people in middle America, outside of our white collar coastal bubbles, are reeling. If covid was the jab (no vaccine pun intended), this may be the knockout punch. I have long been in the deflationista camp - debt, demographics, disruption and less cited but extremely relevant today, détente. And even up until very recently I remained in that camp until now.

Before Russia’s invasion of Ukraine, CPI in the US printed 7% year over year.

Although seemingly rapid, the post-covid global recovery has been on rather weak footing. Governments were largely able to paper over the cracks with record central bank monetary injections, private debt nationalization and the first direct foray into MMT and UBI style fiscal policy. It’s proven to be just paper over the cracks indeed as supply chain issues and steep labor shortages have begun to weigh on the slowing economy. The latest Atlanta Fed GDPNow projects a measly first quarter 2022 growth rate of 0.0%.

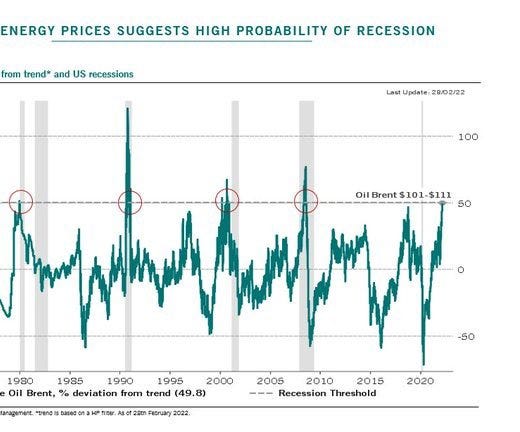

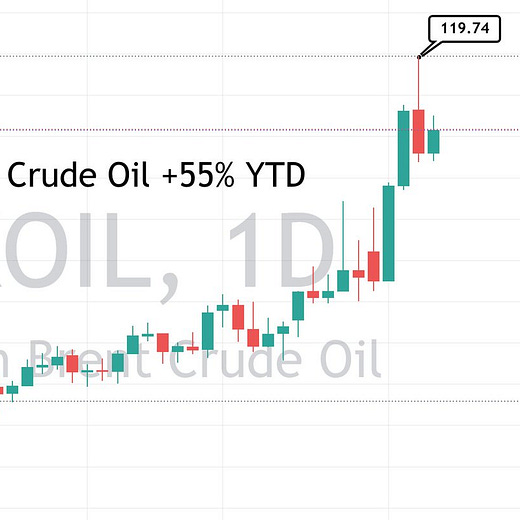

Before Russia’s invasion of Ukraine, Brent and WTI crude oil was trading at over seven year highs.

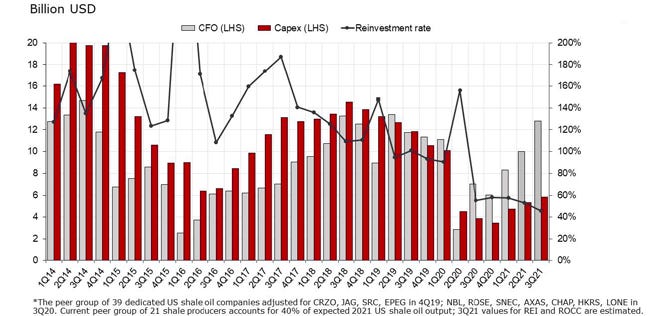

This is on the back of a chronically underinvested US energy system. 2020 and 2021 had the lowest annual U.S. oil and gas capital expenditures in over a decade.

I love the push to renewable energy just as much as the next person but the government and regulatory agencies’ mishandling of mission critical infrastructure is appalling. Now that the politicians’ necks are on the line, it’s an area of focus again and a national emergency. Back in my investment banking days I used to work on a lot of oil and gas debt financings, but in the last few years of that it was largely all renewable and energy transition deals because when you tried selling loans and bonds to institutional investors that had even a faint scent of oil and gas or fracking association, they ran for the hills and screamed ESG. So thus is to say - this isn’t a problem that will be solved anytime soon. Capital expenditures in the field take time to ramp up and given the high level push to abandon the industry, we will not see millions of barrels in new production come online overnight.

To add to the already severe problem, Russia is the world’s second largest gas exporter and third largest oil exporter (17% and 12% of the global supply, respectively), the majority of which goes to Europe who doesn’t have nearly the internal production capabilities of the US. They’re in for a rude awakening but no one is going to come away unscathed. As I read the headlines of the west banning Russian imports, I’m really curious as to what the game plan is here. Time will tell.

Before Russia’s invasion of Ukraine, US wheat prices were trading at over nine year highs.

Now incorporate the fact that Russia and Ukraine export ~25% of the world’s wheat. Global food prices were up 28% in 2021 and are set to compound on that given the lagged impact of agricultural commodity prices on food. The US only imports roughly 8% of the supply needed for the consumer packaged goods industry and most of which comes from Mexico and Canada. The shining light here is that it could provide a boost to US farmers who have been hit so hard the last number of years. However, the trouble on this horizon may lie in another part of the world.

So where do we go from here on the topic of inflation? Well the data certainly points to a worsening before an improvement. And this leads me back to the consumer where sentiment is worsening by the day.

The markets are offsides right now. At the time of writing this the S&P is only -10% from all-time highs.

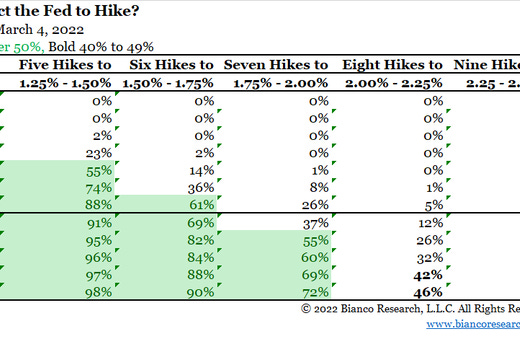

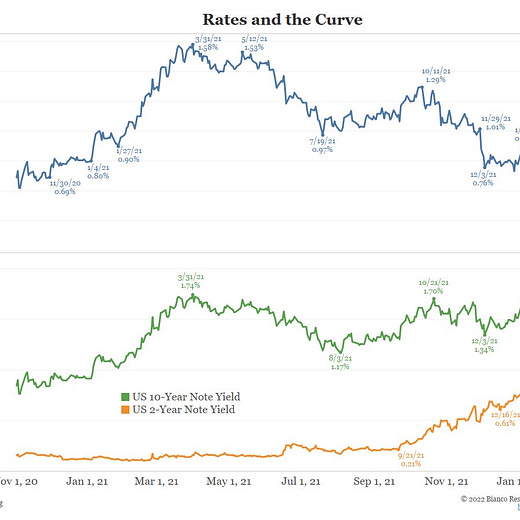

Markets have become so accustomed to the Fed put that it’s assumed we will all be rescued so swiftly again. The truth is it’s a lot murkier this go around. The Fed is stuck between a rock and a hard place - trying to fight rampant inflation on one hand and an economy grinding to a halt on the other. Up until a few weeks ago the market was pricing in seven rate hikes for 2022 and even a chance for 50 bps in the upcoming March FOMC meeting. Obviously that’s coming down rapidly - under five today and looking like it will collapse further.

So what is the Fed to do?

Do they seek to curb inflation and hike interest rates or unwind the balance sheet in the face of a slowing global economy and war?

Do they axe tightening in an attempt to buffer the economy, risking an even worsening inflation picture that could crush the US consumer? Can they really print another $5 trillion in this inflation environment?

It’s evident that policy mistakes have already been made time and again, and will continue to be made. It’s just that now we’re to the point where the rubber hits the road and the repercussions will be seen and felt in real-time. Strap in.

We can examine historical events to predict what will happen next. When market turmoil gets worse enough, the Fed will be forced to step in.

Powell has already begun the pivot. My gut tells me it will be relatively swift, but maybe not too swift as it will be a hotly contested debate to attempt a careful threading of the needle. Given the likelihood that significant central bank intervention will worsen the pressure on the US consumer, it will need to be accompanied by even larger scale fiscal stimulus than we saw during 2020. If that was a dipping of the toes into MMT and UBI style policy, this may very well end up being a head first pencil dive.

And this is where crypto comes into play. There’s a cohort of people that got this hint and saw the light in 2020, but then there’s the 98% of the world who have yet to grasp it. Events like the Canadian truckers asset seizing, the weaponization of money, the overnight cancelling of Russia’s foreign assets are the best forms of marketing Bitcoin and decentralization could ever dream of. The bull case is becoming clearer by the day.

And despite no-coiners aims to paint the crypto industry as rooting for the doomsday scenarios, spend one week in the industry and you know that to be the most bald-faced lie. It is an industry full of young, optimistic problem solvers who are anticipating these future problems and taking matters into their own hands to build a better solution. The same people who had absolutely no part in putting the global economy and geopolitical affairs in the place they are today but rather have watched from the sidelines as baby boomers have held power for the longest tenure in any generation.

I just want to say - wake up and smell the coffee people. Complacency is costly. There are many historical parallels to today that draw from the lack of action. That can be seen in a failure to act or maybe a failure to react.

But a parallel I’d like to offer up is in relation to today’s monetary system. The repeated “one off” or “first of its kind” monetary policy decisions and events since the Global Financial Crisis may be new to us living in today’s developed world. But they aren’t new to people in developing nations who have faced repeated economic collapses and currency crises. They also aren’t new to the people who lived in the Weimar Republic in the 1920’s.

The near-term could be a bit bumpy for Bitcoin and crypto alongside the rest of ‘risk assets’ if there is a meaningful sell off. These are still widely misunderstood asset classes that get bucketed together, when in reality comparing Bitcoin and Ethereum or other ‘cryptos’ is like comparing gold and Apple stock.

However, when the dust settles (and likely even before that) the value proposition will become glaringly obvious in hindsight. It is pretty cool to be a part of an industry that is committed to creating a better, more sustainable future. It’s pretty cool to be building infrastructure and technology that will matter on a global geopolitical level. And it’s pretty cool to belong to communities of like minded people that do things like raise $50 million to support a war torn country in a matter of days.