Scouting the Tape - Jan 25, 2026

(Unique) macro idea generation and (insightful) market thoughts.

The sheer amount and velocity of news flow to start this year has exceeded even the elevated levels we have all come to expect from a Trump presidency. I expect it continues and requires a very dynamic mindset. Let’s stay nimble ahead of what is likely to be another eventful week. As mentioned last week, this isn’t a recap or news update but rather thoughtful insights and ideas to help spark readers’ own creativity or just add value to your process and portfolio.

2s30s yield curve is too flat.

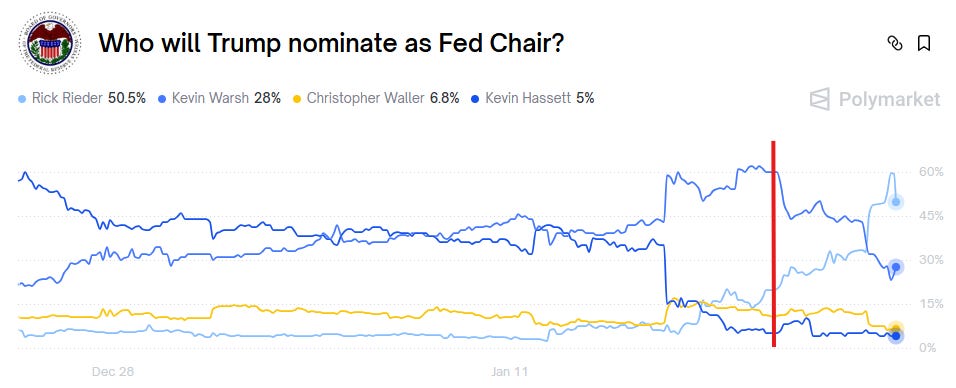

Last week yields peaked on the Trump Greenland TACO, but it’s interesting to me it also coincided with Warsh’s Fed Chair odds also peaking. I have noticed market participants are very fond of the Rick Rieder potential appointee news and I have no reason to doubt their sentiment. But I do doubt that any of the potential nominees can cure what ails the bond market. It also should be a fair assumption that any leading candidate being considered is telling Trump what he wants to hear about rate cuts, otherwise they wouldn’t be chosen.

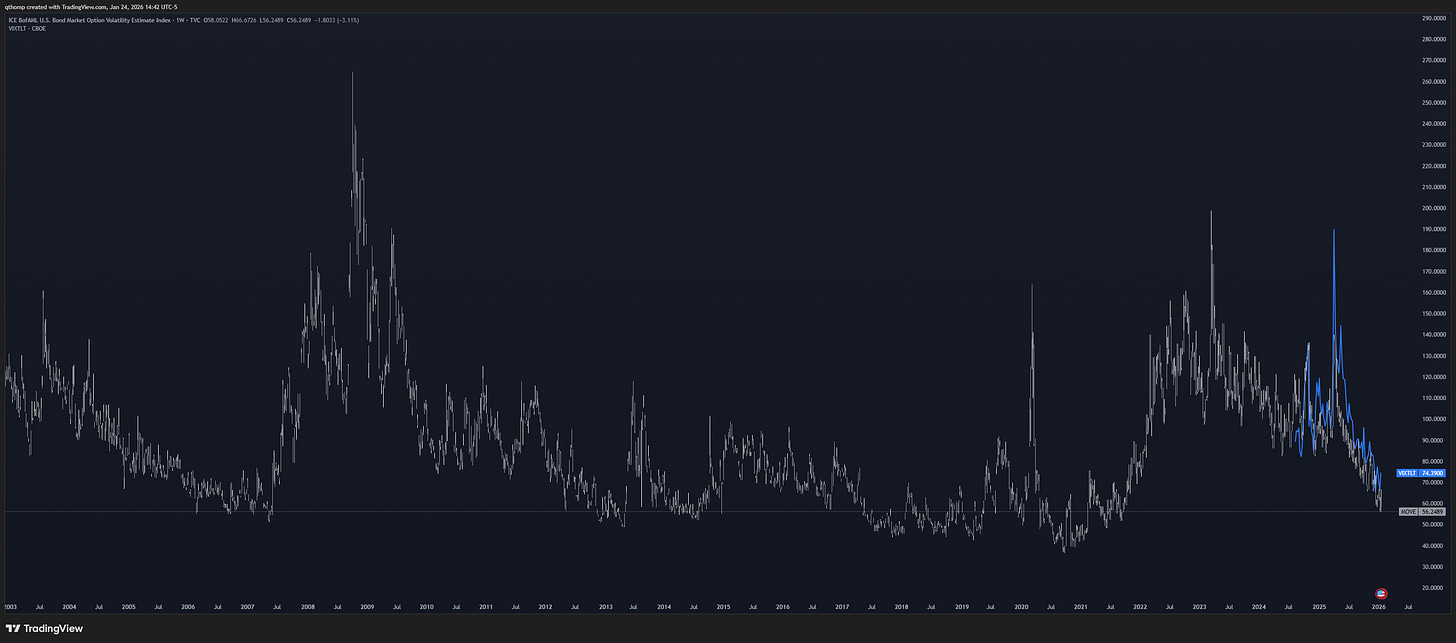

The problems facing the bond market are severely structural, with pre-existing secular pressure and soon to be cyclical pressure as well (which was missing for the last 2 years). Not to mention it seems we are not too far away from additional policymaker intervention to weaken the dollar which would be fuel to the fire.

Long end yields have consolidated for a month and a half on an upward sloping trend line. I like playing for something like this on the 30yr by April/May.

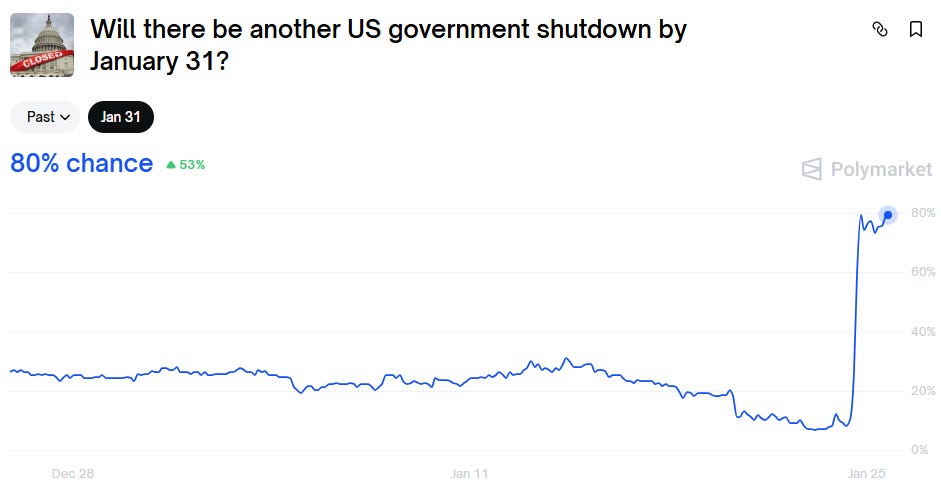

We may get an attractive entry this week on shutdown fears.

When structuring that trade, I’d also prefer to be long vol than short it. I have less conviction on this aspect of the expression in the near-term but if you ask me does bond vol see higher or lower levels over the next 1,2,5 years, I say higher.

Metals caution.

You will not find me trying to short a sector I am extremely secularly bullish on. I have been a gold/metals bull since late 2022 and was pounding the table hard on multiple occasions including July and August of last year before this recent historic leg up. That said, I’m nervous here locally. Trees don’t grow to the sky in a straight line.

From Friday’s message in the chat I said, “Felix and I found ourselves ending this Forward Guidance recording cracking jokes about the periodic table. Lastly, you have silver pressing up into a huge $100 psychological level. All that is to say - I have found myself thinking about the age old markets wisdom that when you’re high fiving and cracking jokes, you better be making some sales…my focus for the year is to resist being dogmatic and don’t get married to any view or asset…one question I like to ask myself is how likely is it I’ll get another chance to buy a given ticker at these levels.” My current view is ‘very likely’.

I say this in a joking manner, but don’t ask me for any more specific reasons why I am cautious. Everyone has seen the RSI extension charts, overbought levels, etc. etc. This whole rally has been unorthodox and wild and numerous times I’ve warned against calling a top in metals. I mentioned the Yen/Dollar currency moves in the chat Friday and this could be a source of vol for the metals complex. I’ve had the best start to a year I’ve ever had and am just fine with not being max long until the pico shmico top. I’ve seen enough signals from my process to take my ball and go home for a bit. Sometimes it’s good to pinch yourself and remind you that flat is a position. My biggest metals position that remains is copper but everything else is on the chopping block in the short-term.

My short Mag7 and large cap tech timer may run out this week if I don’t see enough further progress made to the downside.

We got a strong drive down to start last week but it was bid up hard. The market continues to prove resilient with internals and technicals also holding up well.

I have been short Mag7 and large cap tech against my longs for almost 2 months now and my timer for a more substantial downside move is running long in the tooth. It has been a very profitable trade and was unique then, but is now becoming mainstream news. MAGS is flat since September while everything else has ripped higher.

Shorting any market is difficult, let alone an all-time record bull market/bubble with secular inflation causing an upward drift to nominal asset prices. As we’ve seen, using funding shorts to reduce market risk of a portfolio, and playing sector rotation trades has been very profitable. That said, you never want to overstay you’re welcome on the short side.

The good news is - I have some ideas brewing for new funding shorts I will share soon.

China is front-page news, but I don’t see many connecting the dots.

Everyone understands the emerging market thesis and have bid up almost every non-US stock market, except for their largest supplier and financier. Here’s my take - China is to emerging markets what the US is to developed markets. Many developed markets are facing uncontrolled debt burdens, fiscal sustainability issues and fiat currency crises - problems that emerging markets know all too well. The difference is many have already faced the brunt of these issues (for now) and are actually benefitting from greater disinflation due to cheap Chinese imports that have been steered away from the US. All else equal this means greater room for fiscal and monetary stimulus across EM.

Recent Carney and Macron statements - bullish China (eventually).

News of China’s military investigations - no Taiwan invasion soon.

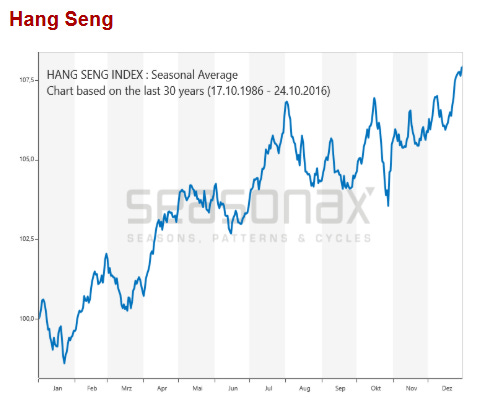

And why not throw in a seasonality chart for good measure.

Let’s see how markets react early this week on the military stuff and go from there.

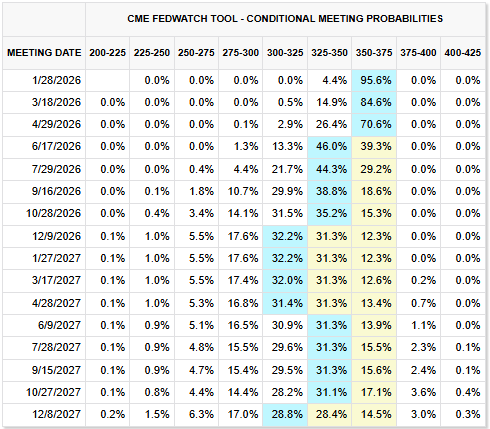

Hope everyone has a great week. To leave you with some food for thought heading into another FOMC meeting on Wednesday - I’m not really sure what Powell could say to price in a more hawkish route than what is currently expected. 70% odds of no cut through April still seems too high to me. That framing may be useful to your positioning throughout the week. I’ll also take the under on government shutdown length extending beyond a few days as neither party has any political capital to spare heading into midterms.

Good luck out there. Intra-week thoughts and updates will be posted in the subscriber chat.

Food for thought, thanks Quinn. If you like China, BIDU looks like a strong, trending chart. Daily cycle coming up soon, I’m monitoring for a slight pullback/bull flag consolidation to potentially initiate a position. It’s been leading the Chinese tech names and taken over from BABA recently. Also keeping an eye out on Popmart, might be making a comeback after a long period of distribution. Too early to tell right now, but sth to monitor. Regarding the Zhang Youxia stuff, that’s less about China but more of a huge internal power struggle. There is long tail risk of a bad bad stuff on this issue. Not about Taiwan but more internal CCP struggles that have the potential for huge vol. One of the big known unknown risks IMO

Not a macro guy, I’m just a humble futures trader….but just wanted to say, i don’t think I’ve seen anyone else nail the start of the year as perfectly as you did. Congrats Quinn. Big fan.