The Elephant in the Room

Quick thoughts on the recent dollar devaluation vs. Yen...

There’s a big shift ongoing that took another step forward on Friday and I have not heard anyone discuss it in the way I am thinking about it. The impacts of deliberate and coordinated currency devaluation by two of the most indebted countries in the world has gotten a lot of attention as it deserves, but I don’t see nearly enough second order thinking connecting the dots to investment portfolios.

In simple terms, Friday’s USDJPY intervention and follow through this week signals coordinated policymaker action to weaken the dollar. Mind you this is coming at a time when no volatility has shown up in the equity markets, global fiscal deficits are still running strong and the K-shaped US economy remains sturdy at an aggregate level. For some, this is an easing of financial conditions, think consumers of oil or other large US exports. For US customers and consumers, it represents more of a neutral to tightening effect as imports to the world’s largest importing and consumption driven economy become more expensive.

The goal of this piece is to provoke increased thoughtfulness around the second and third order effects of these policy changes. I will list a few points I am thinking about and try to keep them brief as I am still processing all of the impacts myself.

Global capital flows are shifting.

A few weeks ago on Forward Guidance we discussed the massive decline in US trade deficit. We are starting to see the beginning of the strategic rebalancing that the Trump administration has been pursuing since inauguration in 2025. This has material implications for capital flows as there are less dollars proliferating around the globe to be recycled into US assets. The recent Japanese intervention is a practical example of the effects of this playing out in real-time. The yen has been weakening too much relative to the dollar, so the Japanese government intervened by selling dollars to buy Yen. The capital to transact has to come from somewhere, and given they are intentionally weakening the dollar, it would be logical for them to sell US assets as well (aka Treasuries). Even if they aren’t, it doesn’t really matter because the US and Japanese governments, in a coordinated effort, are sending a signal to the market that they will do what’s necessary to weaken the dollar. So if you own dollar denominated financial assets, the natural response would be to either sell some of those or hedge the currency to reduce your dollar exposure.

Why does this matter? Because it is a very clear action that says the quiet part out loud. As foreign demand for US assets decreases, the US government (Fed and Treasury) will be forced to play a bigger role in financing the unsustainable government deficits and US capital markets.

With a stubborn and politicized Fed, the White House and Treasury are taking matters into their own hands.

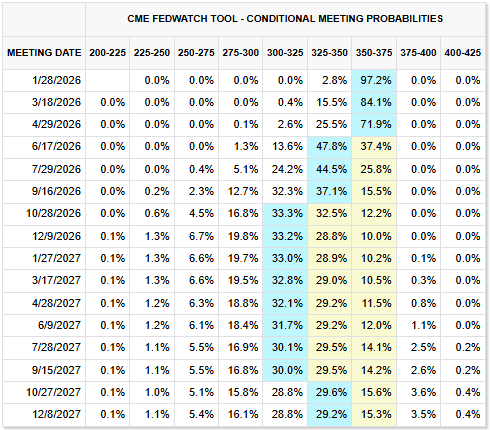

Labor market data continues to weaken and forward inflation continues to look benign, yet the market expects no cuts through April and a shallow cutting path thereafter (likely due to the chance that Powell stays on as governor).

Trump and the White House have been trying every means necessary to effectuate a looser Fed rate policy but their latest actions have likely worked against that effort as seen by Powell’s Sunday night video and attendance at Lisa Cook’s Supreme Court hearing. This has forced the administration to seek other means to achieve their intended outcomes. A dollar down move of this magnitude is showing there are clearly larger forces at play that are moving chess pieces around the board.

What’s not being talked about enough is what this means for the rest of the commodity complex outside of metals. I believe gold (and indirectly the other metals) have been front running this next leg of dollar debasement. The market is still trying to figure out what shape or form it will take, but it’s clearly happening.

The trade after the trade is understanding what comes next and for that one should look across the rest of the commodity complex. I think this puts a tailwind behind the price of oil given the fundamental and geopolitical outlook that already exist. Bitcoin and crypto are also interesting to me here. While small caps and other pro-cyclical and liquidity beneficiaries have rallied hard, Bitcoin has continued to lag. Bitcoin has had over 4 months now to work through an extreme amount of selling. While I’m not convinced the conditions are imminently ripe for the next major bull run leg, I do think it outperforms small caps from here and if we were to get positive news and a macro leg higher in equities, I believe it would lead there as well.

Increasing demand for credit.

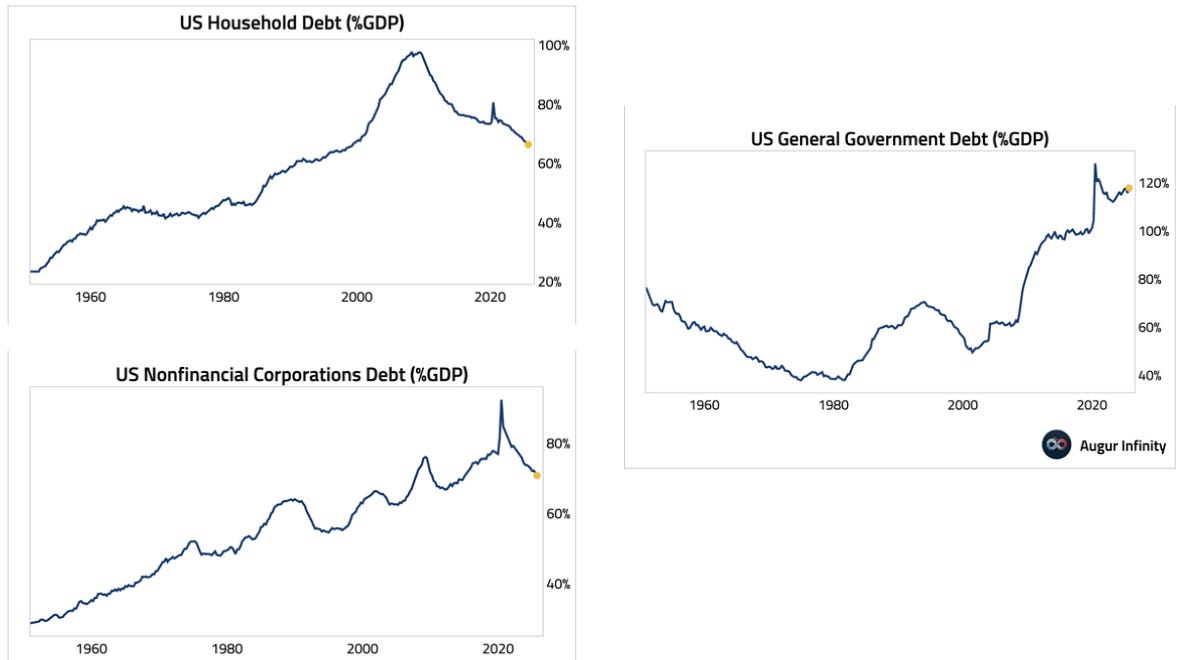

Another important element is the tax-incentivized capex boom in the US. As it continues to progress, we will see a sustained increase in demand for credit from both consumers and corporates, the two cohorts of the economy with the least levered balance sheets. We talked about this as well on FG.

So while the change in trade deficit and capital flows represents a reduced supply of foreigners willing to financing US capital needs, a reinvigorated main street economy represents an increased demand for financing from US households and corporates. In tandem, these are two sides of the same negative liquidity coin, and there is only one game in town that can provide the requisite backstopping - the Fed. When you consider Friday’s actions amidst the backdrop of functioning markets and an increasingly dovish monetary policy stance (reducing QT, ending QT and restarting QE all sooner than expected), it appears there is a growing appetite from policymakers to backstop markets more pre-emptively. You can’t even really call it papering over the cracks, it’s more akin to laying new concrete before cracks even begin to surface.

Long duration bonds continue to be a horrible investment and while governments routinely intervene to slow their demise, that intervention shows up elsewhere and can be capitalized on, if not expressed directly in the bonds themselves.

In summary…

Recent global policymaker actions have demonstrated a continued increase in willingness to become more and more preemptively stimulative. Whether that’s the growing fiscal burdens, Trump’s attempts at main street reignition and Fed policy influence or the recent currency interventions, the direction of travel is clear that fiat currency will continue to be sacrificed at a more rapid pace. This does not mean be max long risk assets because everyone is already in the boat. It does mean there will continue to be an abundance of opportunity because where free markets are intervened upon creates excess, imbalance and capital misallocation. The most important thing is to keep an open mind.

Secular inflation provides a tailwind to all nominal asset prices (except bonds) over the long-term, but the prices you pay for your assets of choice still matter immensely and the dispersion and rotational violence can happen quick.

The administration is telling you they want the dollar lower and this should be a key input into your investment allocation process. In the short-term, they have a non-cooperative Federal Reserve which is likely to make for a bumpy path. My focus is on buying secular winners at value prices and shorting secular losers when they become too rich. Don’t let the day to day moves stray you from the overarching path here.

At the highest level and in simplest terms, this coordinated policy approach says to sell US assets because that is what the governments who control the strings are doing. The reality is it is more nuanced than that.

I'm confused. Isn't a weaker dollar bullish for US assets?

Hey Quinn, good piece, and I agree this is being massively overlooked - though flows are moving and frontrunning this, especially in smaller markets like commodities.

We may be seeing something close to a soft Plaza accord, at least with JPY and KRW (have a look at that chart too and tell me there was no intervention!), as the US tries to shrink its current account deficit and rebalance away from defacto global reserve, which has been good for asset holders but horrible for Middle America and US industry.

This matters hugely because the premium valuations of US asset prices (be it US stocks which dominate global indices or US treasuries not blowing) is a direct response of the current account deficit, and those flows being recycled back into the US, which has caused a huge negative net international investment position that leaves US assets vulnerable.

Trump said the main part out last year (main streets turn now), but the timing was not great and the bond market revolted. Everyone thought he'd completely TACO'd with DOGE, but the truth is he has to go down this route to confront China. Now they seem more confident, especially if they can get a favourable Fed chair. At the same time a weaker dollar / global reflation would allow them to run it hot, and structurally higher inflation is needed for financial repression.

For asset allocators, DXY breaking a 15 yr uptrend is huge, and comes at a time when emerging markets, commodities, value etc, which have all been left in the mud for 15 years, show signs of finally breaking out. Allocators are very underweight these assets, and these regimes often go on for much longer than expected! I think H2 2025 and January 2026 are a forerunner of things to come...