Scouting the Tape - Feb 1, 2026

(Unique) macro idea generation and (insightful) market thoughts.

The top two points from last week’s Scouting the Tape proved prescient as the 2s30s curve steepened by ~14 bps in a straight line all week and metals had one of their worst sell offs in many years on Friday.

In the January 19th Scouting the Tape, we called for a top in front end rates which has played out, but the best idea from that week was our bearish ETHBTC / low $2,000’s ETH call. Both targets have been met with close to -15% and -30% moves, respectively and we’d now recommend closing these positions out.

This past week I also published another piece titled The Elephant in the Room which aimed to reinforce the significance of the recent FX moves on other parts of the market, primarily cross border capital flows and demand for US Treasuries. I continue to believe the ramifications of these changes have not yet been felt nor well understood by other parts of the market, particularly equities and bonds.

As a reminder, for intra-week updates please join our subscriber chat. I think last week proved to be a good idea to have notifications on for new messages given the market action and timely discussions. Friday began the day with a flashback to the summer 2024 VaR shock and finished the day with a bottom tick metals re-entry.

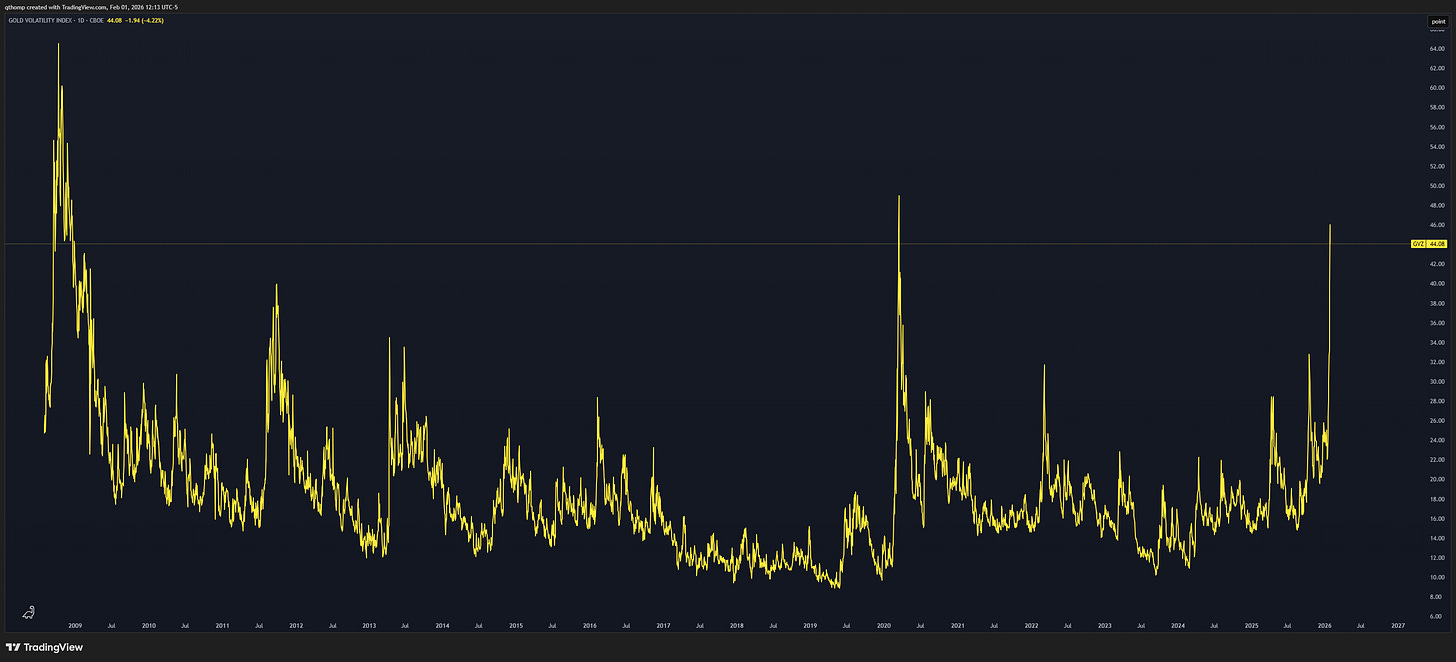

Something sketchy is brewing…gold volatility has only been higher during the Great Financial Crisis in late 2008 and COVID Crisis in March 2020. Trust historical signals of this magnitude and keep your head on a swivel.

I don’t have much to add to this other than I’m trying my darnedest to figure out what it means for the rest of the market. Normally these spikes coincide with large sell offs in the stock market, but we haven’t seen that yet. I think we will and I am betting my capital on it. Don’t be a sleepwalker here.

Something sketchy is brewing…part 2…it’s all fun and games until stocks follow Bitcoin, which happens just about every single time.

Like clockwork, every time there is a -20-30%+ sell off in Bitcoin, it leads a move lower in equities. As the Bitcoin decline accelerated again over the weekend, keep your head on a swivel.

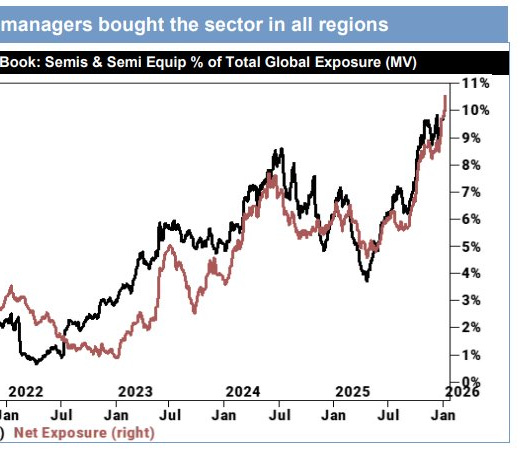

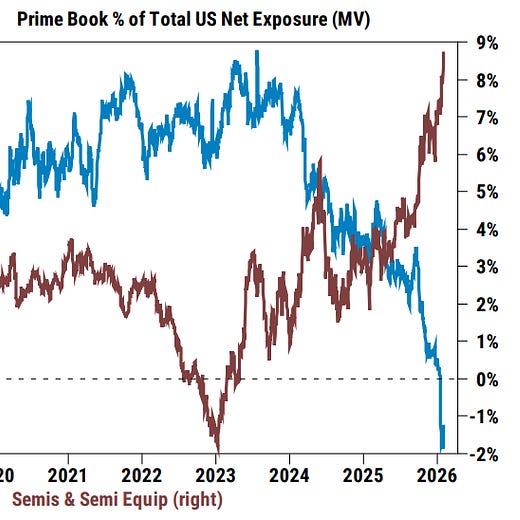

I posted this meme on X and thought it did a good job of summarizing a lot of the reactions I saw over the course of the week. Lots of judgement on the moves in crypto and metals, but not a lot of people taking a moment to step back and think critically about what it means for the broader risk complex. The market has a way of shaking all of the trees where people are hiding out. I posit semis and AI are next on the list.

Something sketchy is brewing…part 3…follow the insiders.

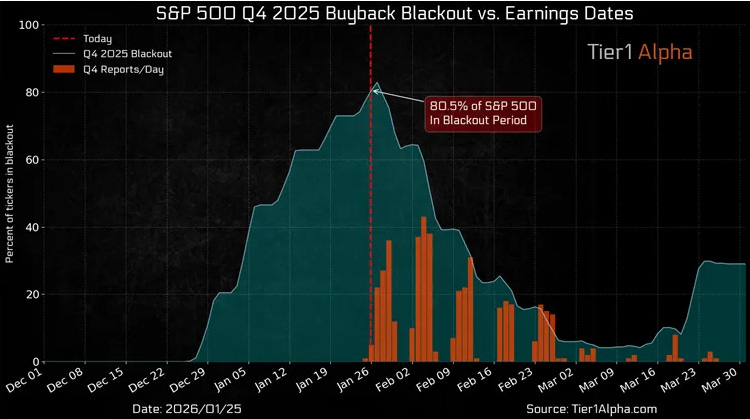

Over the last few weeks I observed a number of comments around the lack of insider selling of late that didn’t make note of the corporate blackout windows affecting most of the market. Sure enough, the second earnings season rolls around and the companies leave blackout, insiders are sprinting to market with their sales at a record clip.

Last week marked the peak restriction window with >80% of the S&P in the blackout period. After this week it begins to fall off much quicker as <50% will remain in the blackout period and declining over the rest of February.

On top of the corporate insiders, in a CNBC interview Bessent noted that last year’s stock market performance doesn’t dictate the next year’s. Could be just an off handed comment but he’s not stupid.

What to do with metals and commodities.

Last weekend I warned of caution as volumes, volatility and prices were all reaching fever pitch levels. By CoB this past Monday I was completely out of the entire complex. While many assets began correcting in the middle of the week, gold and silver continued to blow off until their record sell off on Friday. I thought I was going to be on the sidelines for longer but ended up re-deploying near the lows during the liquidation. Now as I strategize looking forward, I thought this tweet perfectly summed up what’s going through my mind.

Then I also think back to Bessent’s interview with Kudlow just two weeks ago where he said he wants the new Fed chairman to be a Greenspan-like supporter of the productivity boom where 7-8% GDP growth is possible. I’m hard pressed to find a reason to turn structurally bearish on the metals complex. While I do respect the work this admin has done around fiscal sustainability in just one year and believe it doesn’t get enough attention, I think the low hanging fruit has been harvested and I don’t see a path to <5% deficits anytime soon.

Maybe metals don’t go anywhere for 3-6 months and just consolidate to let the moving averages catch up to price after a historical 6 month rally - this would be standard behavior. Maybe they catch a cold on the back of the pending volatility I think is going to hit the equity market. But either way, I can’t stop thinking about the key messages from my Macro Themes piece in that Trump has midterms to win and stimulating economic growth is the path that both underlying political incentives AND their overt messaging leads you to. So maybe the play from here is to focus your metals bets on the pro-cyclical beneficiaries that are most tied to industrial production and the economy. That wouldn’t surprise me in the slightest given the Gold/Copper chart looks like this. If this mean reverts to any reasonable degree of previous instances, say a prayer for inflation.

Not much talk about this week’s Treasury QRA. I don’t know what it will bring and it very well could be a nothingburger, but I think the risks skew towards more Yellenomics. It’s also labor data week with JOLTS, ADP, Challenger and NFP where I’m expecting more of the same trend we’ve been seeing. I have some ideas around the bond market depending on what we get from these two pieces of information.

Hope everyone has a great week ahead. Join us in the chat with thoughts, comments, questions and more discussion!

https://www.youtube.com/watch?v=HhPbsfNKai8

excellent! this also echoes some of what you're looking at, Quinn

obviously gold isn't going for flip Treasuries or global long bonds (tho it has as a reserve asset for CBs..), but it's just *another reason* term premia can go much higher. with energy breaking out, breakevens have risen sharply already YTD.

2.45-2.50 seems to be the the top / ceiling on T10YIE since early 2023, so a break above that would be very meaningful. it's really just been consolidating 2.15-2.45 for 3 years.

meanwhile, dollar, credit spreads, vix and vvix are all rising in tandem - a pretty bad backdrop for risk given the moves we've seen in recent days. stocks are probs 3-4% offside with spreads if you look at the historical relationship since 2022. could be an interesting week..

Great picture painting, thanks!