Scouting the Tape - Feb 15, 2026

(Unique) macro idea generation and (insightful) market thoughts.

This is always meant to be a quality over quantity type of publication and I want to keep it that way. If you’ve been following along you are aware of our general market view, the areas we favor and the ones we dislike. I don’t have much new to add this week as I have laid out my view over the last few weeks on here, Twitter and our Forward Guidance podcasts. We are now approaching the market’s decision point and I believe the next few weeks are crunch time.

I am linking our Scouting the Tape from two weeks ago on Feb 1 as I think the views laid out largely still hold.

Scouting the Tape - Feb 1, 2026

Something sketchy is brewing…gold volatility has only been higher during the Great Financial Crisis in late 2008 and COVID Crisis in March 2020, Bitcoin is the canary in the coal mean for risk assets and investors hiding out in the crowded semiconductor trade are likely to find out its not that safe after all.

I have not been this bearish in a long time.

Expression of the view is important. Looking around the market there are very few places that provide value as even the unloved sectors are now quite loved in the short-term. My view is for a 4-6 week period of weakness in equities that sees particularly uncomfortable downside in US large cap tech, Mag7 and semiconductors.

Cash levels at lows, gross hedge fund exposure at highs, months of distribution in large cap indices, Fed on pause until June, rising geopolitical risks, increased populist/anti-free market policies ahead of midterms…the list goes on of reasons to expect a higher baseline level of volatility in 2026, and therefore reduced exposure to risk assets.

These violent rotations do not occur during abundant liquidity and healthy market functioning. In fact they are usually a precursor to increased violence.

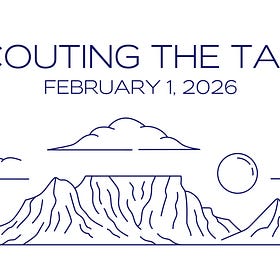

The market is providing numerous cautionary indicators whether it be consumer staples outperformance, the bid for bonds or the underperformance of the Mag7 market generals. Here’s an interesting one for you. While the Mag7 hyperscalers are the largest AI capex spenders and the SMH semiconductors are the receiver beneficiaries, you’d expect there to be correlation. The last time the correlation between the two has fallen this low (negative) was late 2024/early 2025 ahead of the large Q1 correction.

The bond market does not offer safety at these levels.

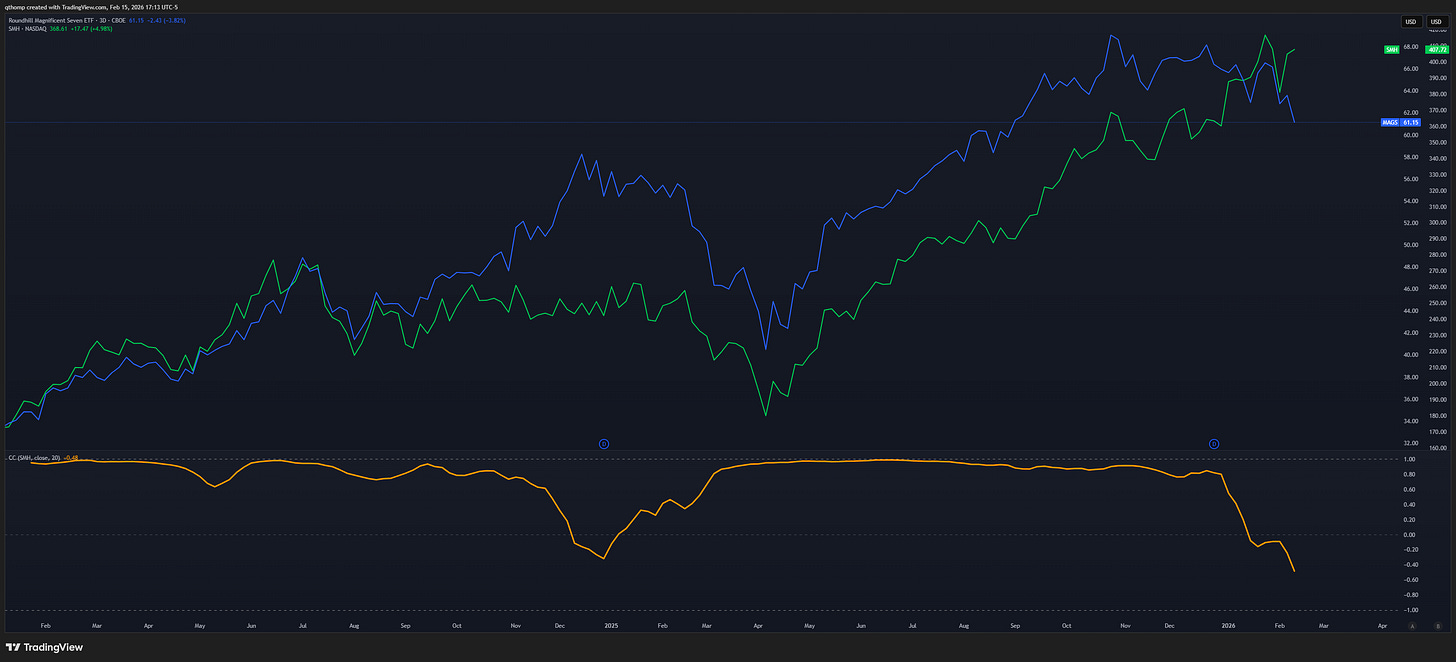

This week’s price action reminded me of Friday April 4, 2025. If I would have written this same view that weekend after it would have also sounded crazy, but hear me out.

What has changed since then? Inflation is slightly lower but global fiscal spending is higher, the Fed is less supportive of long duration and the dollar is weaker. The OBBB is stimulating a corporate capex boom and the administration is doing its best to reinvigorate main street ahead of midterm elections. None of these ingredients make for strong bond market performance.

4% 10yr is still way too low and defies previous norms. Even if the Fed cuts multiple times this year, 3.4% on the 2yr is around fair value as it should yield higher than FFR. 2s10s and 2s30s yield curves are still too flat relative to healthy historical standards and the Treasury and Fed is openly looking to steepen them. As we move closer to the first FOMC meeting of Warsh’s term in June, steepening is likely to continue as the market digests another few rate cuts and additional fiscal policies intended to buy votes are rolled out.

Not to mention, the dollar versus any other global currency are some of the worst looking charts you’ll find in all of markets (bearish dollar). US Treasury bonds are claims on future dollars with a small (too low in my opinion) yield component. Gold and other global currencies are a better safe haven here in my view.

Deflation is politically unpalatable. Scarce, hard assets are still your best long-term bets.

The capabilities of AI are astounding and its acceleration is already creating massive disruption. We have likely not even scratched the surface in terms of its effect on the labor force, employment and change coming our way for the average worker as adoption rates are still in their infancy.

But, hell or high water, politicians and governments cannot allow deflationary busts to occur. Deflation results in job losses and nominal decreases in wages and employment. Financial repression and inflation will always be chosen as it is a much less visible pain. Whether AI has a deflationary impact or not, it will be met with additional stimulative fiscal policies that offset that deflation.

I spoke about this exact topic in a presentation I gave last summer.

Regardless, AI will not be able to create coveted physical properties and real estate and you won’t be able to 3D print life experiences with loved ones or scarce goods.

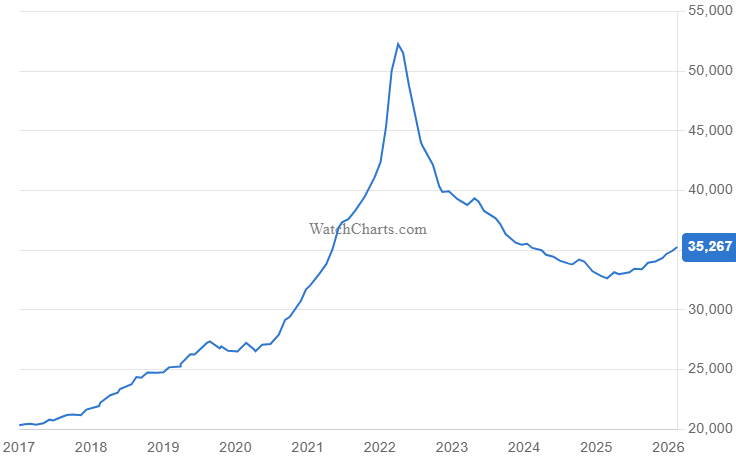

The luxury watch index is a great example of this as it has already bottomed and is turning up. The rise in collecting cards is another example - the trend is here to stay.

It’s a holiday shortened week that’s lighter on economic data but still has plenty of events - monthly options expiration, a potential Supreme Court IEEPA ruling, and continuing Iran talks.

I’ll be boots on the ground in Nashville for Tony Greer’s macro conference. We’ll be doing some live Forward Guidance interviews as well which should be fun.

Thanks again to all who are participating in the chat. Dialogue has really picked up and is getting quite active as it has been a great place to share ideas, hear differing opinions and strawman market views.

I hope everyone has a great week.

Thanks Quinn, very interesting as always. Wish I could make it to Nashville.

Good article Quinn. 2 questions:

1) If the gov goes the financial repression route, isn't this good for US equities and Mag7?

2) Regarding deflation point 4, AI can't create new land, but can't AI be used to expedite a lot of the permitting processes that add $ and time to new housing builds leading to a cheaper housing supply hitting the market?