Scouting the Tape - Feb 8, 2026

(Unique) macro idea generation and (insightful) market thoughts.

“Another eventful week”…said everyone for the 6th consecutive week. If you’re not in the chat yet, I highly suggest you join and participate. I provide updates as relevant (often daily) and we are getting some good dialogue going - shoutout to everyone sharing their thoughts and ideas.

Last week we managed to catch solid moves on both the short and long side of the market. We came into the week with a negative bias and added to it on Monday/Tuesday before closing all shorts and adding longs on Thursday. I typically am not this active on large positioning changes but as I’ve been saying for a few weeks I think this market environment calls for increased tactical operations.

About 60% of the S&P 500 have now released Q4 earnings and this coming week is the last major reporting stretch. That could help add some support to the market as buyback blackout windows end in earnest. We are still awaiting the Supreme Court’s IEEPA decision and the Iran situation continues to boil in the background. I wrote about the dilemma the US faces with Iran and my conviction around a strike has been waning of late. The last thing Trump can afford right now is a spike in oil prices and risking approval ratings by engaging in another Middle East conflict. I don’t have a terribly strong view but that was one component of my bullish flip on Thursday. I also don’t think IEEPA will be anything groundbreaking as it would be unlike the Supreme Court to do anything that puts the country in a disadvantageous position (eg tariff refunds), while tariffs have largely settled in at their run-rate pace with some risk towards reduction on increased dealmaking.

Metals got that dawg in ‘em. Fade at your own risk.

I’ve been saying this for a few months but the number of obituaries written at every local metals top is really stacking up now. Meanwhile China just announced its 15th straight month of gold accumulation. GDX looks like a very normal pullback and a screaming buy to me - it couldn’t even sniff its yearly open. I got very long last week.

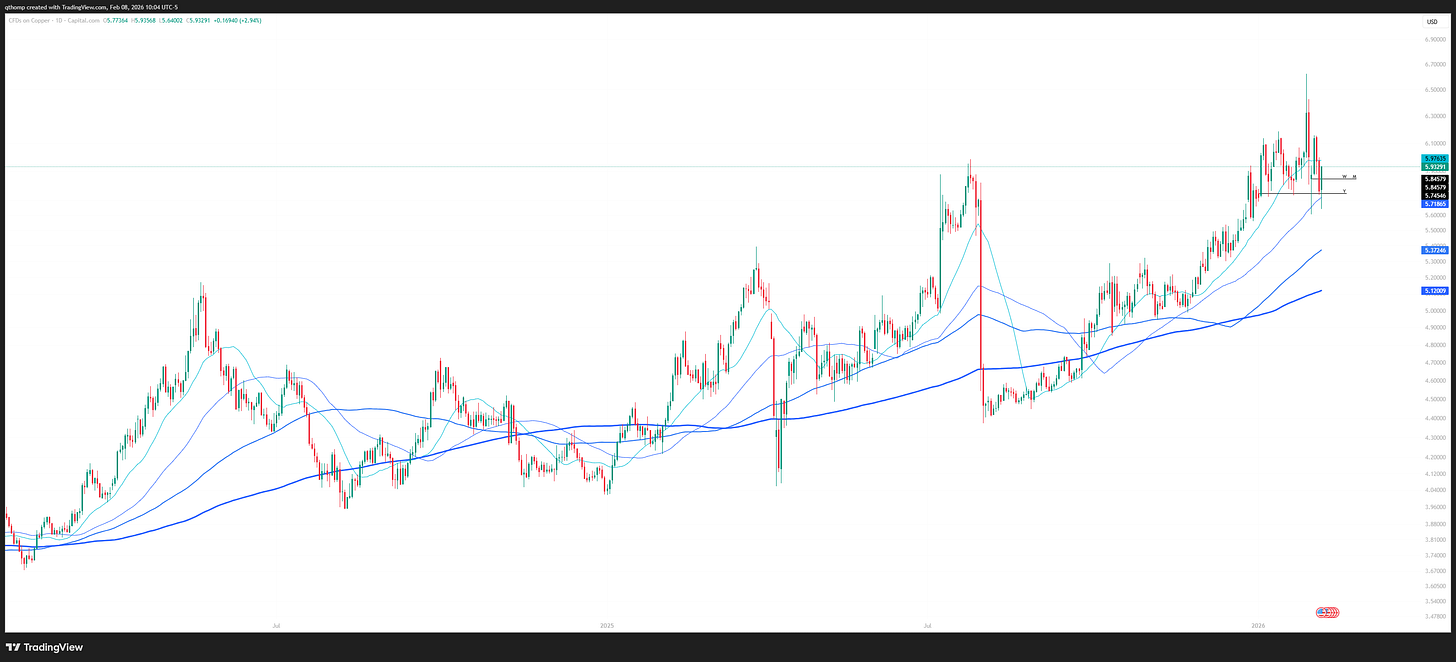

And copper?

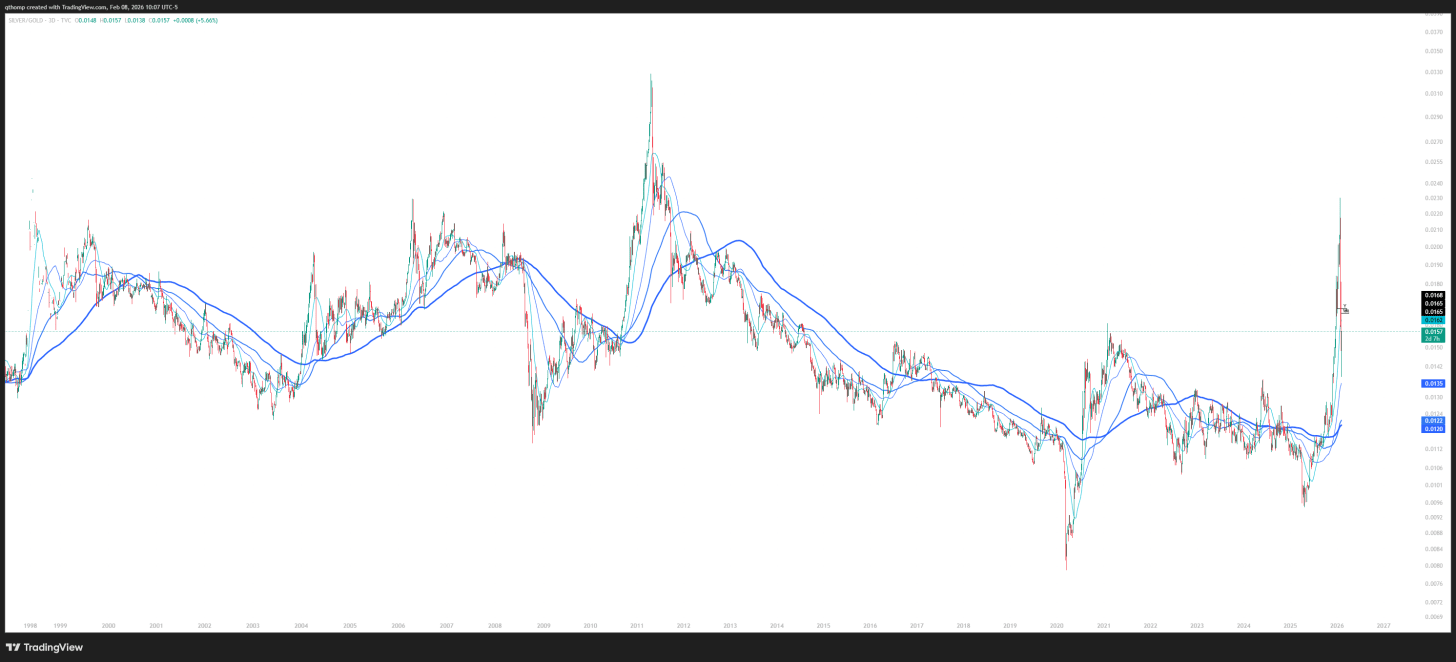

And silver? You’re going to get bearish silver when its down -40% outright and -30% vs. gold? All while the Chinese consumer is just starting to heat up? Find me a time in history where this first dip is not to be bought.

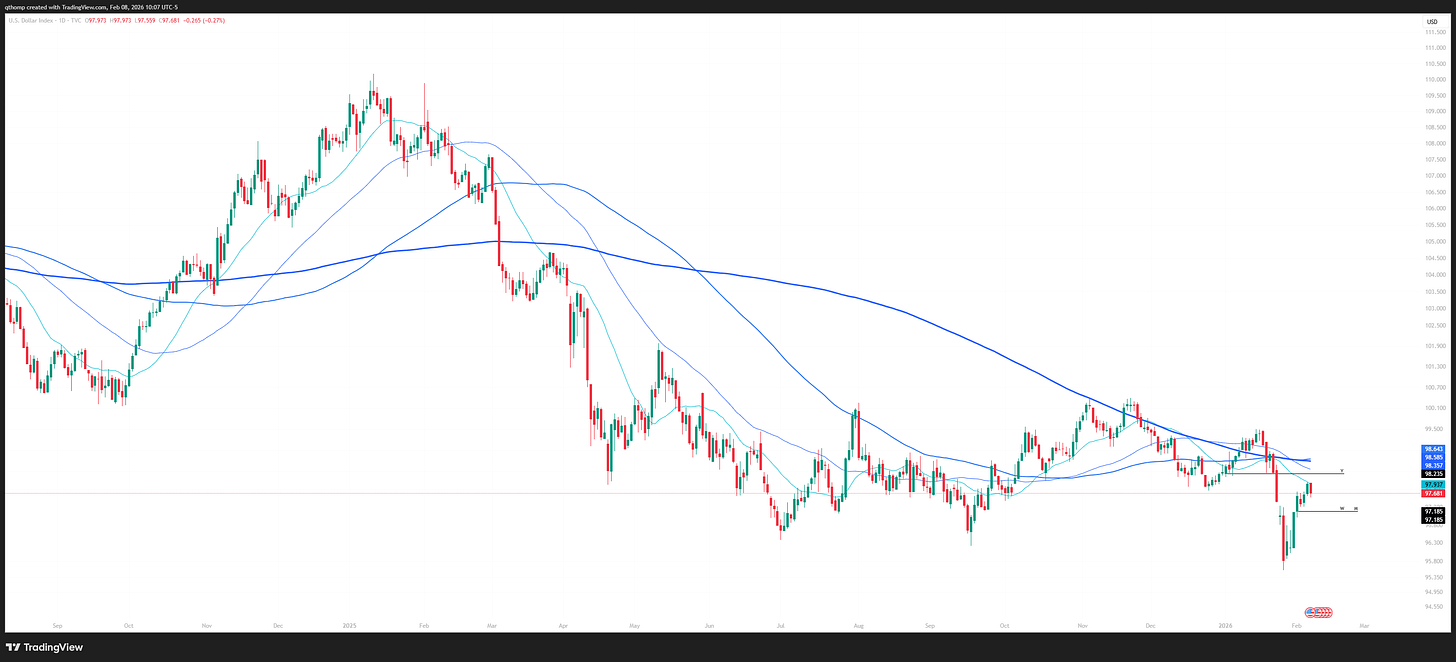

Meanwhile the dollar looks like this and might be rolling over again…

…and USDJPY is back to the area where the BOJ intervened and metals roofed.

Unless you think Trump appointed a Fed chair who’s not going to follow through on the #1 requirement from the job description (cutting interest rates), I think you have to be a metals bull here.

I’ve been talking about China for a few weeks and it’s been on the smaller side of things for me with some trading in and out, but read this as me starting to pound the table to buy China.

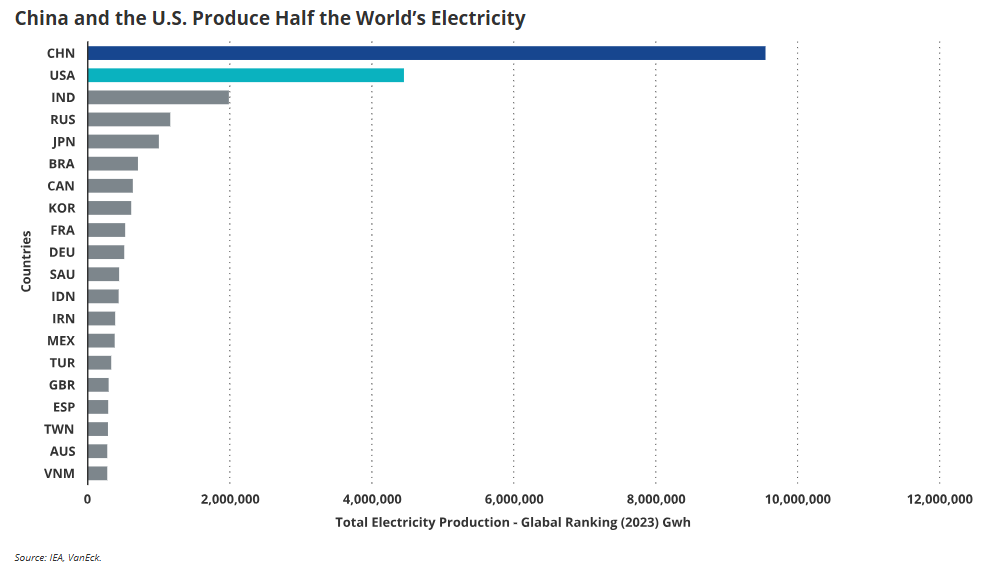

There is a major aspect of China’s industrialization over the last few decades that many are missing - the grid buildout required for that is now becoming more valuable than ever in the competition for datacenters, AI and compute. And China’s lead in electricity capacity is not even close.

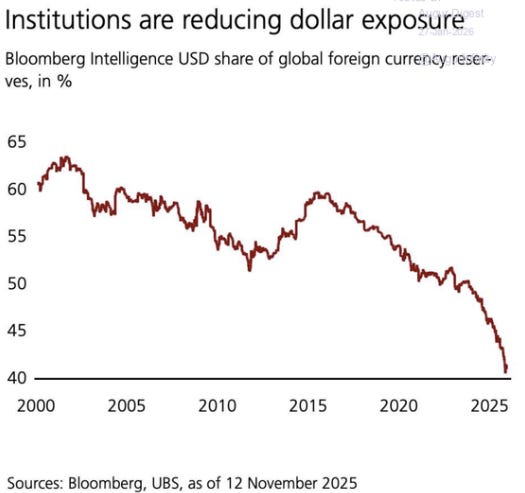

China has been the largest acquirer of gold for years, which has also been the top performing asset in the world. In a world where Treasuries are falling as a share of global reserve assets and gold rising, this bodes well for China. They just clocked their 15th straight month of gold accumulation.

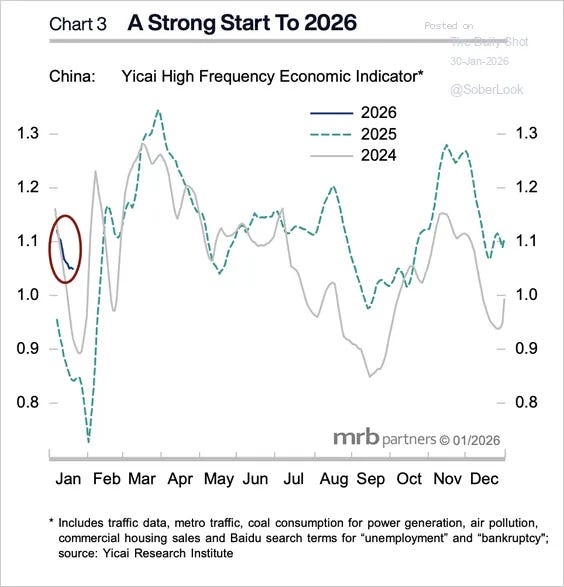

Many early indicators are showing the Chinese consumer is off to a very strong start in 2026. Chinese e-commerce platform JD.com data shows that since the launch of the New Year Goods Festival on January 25, the search volume related to New Year goods increased by more than fourfold year-on-year. This shouldn’t come as a surprise to anyone given their goal to lift household consumption from their recent 5 year plan released last October.

Lastly, long China in many respects is a great way to position for a Democratic victory in November’s midterms. A reduction in Trump’s unilateral authority likely provides more runway for China to take lead on the global stage.

I continue to believe investors are way too apathetic towards the bond market. There are large risks boiling under the surface.

I really can’t stress enough how much a weaker dollar matters for the go-forward market environment. It both puts a floor under commodities and inflation and incentivizes financial capital flight out of the US. This at a time of a capex boom and larger than usual financing requirement in the US is extremely both inflationary and bullish for yields. Read my recent piece for further context.

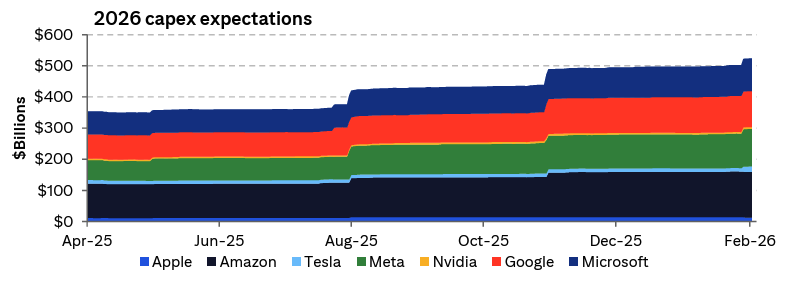

US public and private sector supply - the US continues to run >5% fiscal deficits and has faced supply problems for years that have crowded out the private sector. But now thanks to the OBBB’s immediate capex expensing, we are seeing the spending boom also take hold in the private sector. On top of that, the AI buildout continues to increase in velocity with every hyperscaler blowing analyst estimates out of the water. The ramifications these have for cost of capital cannot be understated. Demand for debt financing is booming while supply (via foreigners and Fed balance sheet) is not supporting the growth - it must come from somewhere and that means yields will rise to bring enough buyers out of the woodwork.

Global yield spillover - Japan is just one example and it looks like their stimulative policy just got reinforced with huge victories in the snap election over the weekend. On top of that you have Europe and China also doing major stimulus. Global run it hot policy is real.

Warsh’s policy objective is to continue the balance sheet duration reduction that the Fed began in Q4 of last year. This will continue to be a negative for the long end of the curve and cause significant steepening as FFR cuts occur.

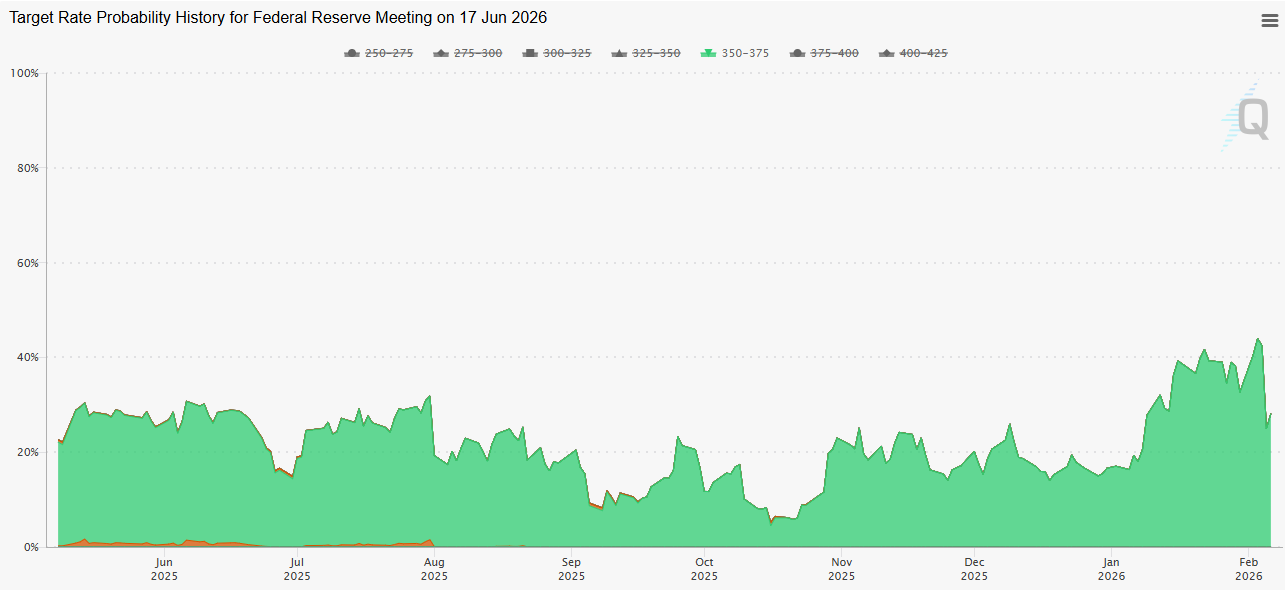

Fed cuts accelerating - we have been pointing this out for weeks and another weak labor data week has pulled forward rate cut odds as we’ve been expecting. We are now seeing white collar job losses join in the main street and manufacturing woes. It is not surprising at all to see the Powell Fed begin to change their tune in a more rate cut amenable fashion after the white collar job losses begin, despite brushing over the main street recession that’s been in full force since 2024 because of their policies. The political elite policies leave the average Joe behind yet again.

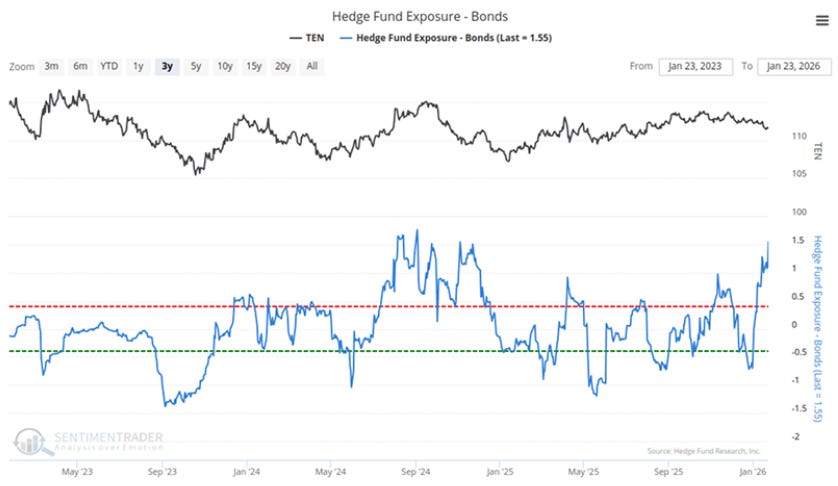

Positioning has gotten bad again as the recession scares have built up in recent months. “Investors are piling into intermediate Treasuries”.

I think investors piling into bonds here due to recession concerns are going to be hurt very badly. If we get any signs of growth problems, the administration will be launching an full scale stimulus attack given the midterm election year. It’s just such a lose-lose setup for bonds in my view.

Has everyone forgotten about the Supreme Court’s IEEPA ruling? Not that I think it’s going to be anything dramatic, but the risks to me are only towards higher bond yield outcomes, not lower.

There’s so much going on in the world of macro right now and a plethora of opportunities if you’re looking in the right places. The most money to be made this year will not be in trying to figure out the direction of the next 50 points in the S&P 500, but rather playing for dispersion and loading up at attractive entries to your favorite long-term secular trends. There will be occasions just like every year where investors are forced to sell what they can, not what they want. I think we just had one of those in metals.

This week we have the last big slate of earnings, a bout of Fed speakers, retail sales, NFP and CPI. It’s an action packed week into a long holiday weekend (President’s Day 2/16). We also have the ongoing Iran situation as talks continue and the US is still amassing a military build up in the region.

Join us in the chat for more real-time discussion and insights.

Have a great week out there.

My new favourite Substack - thanks Quinn.

Quinn - appreciate the specificity and clarity of your pov. Curious, what do see as the advantage(s) of the miners (GDX) over physical gold (e.g., PHYS)? Thanks.